With December 31 information, right here’s the image of time period spreads:

Determine 1: 10yr-3mo Treasury unfold (blue), 10yr-2yr Treasury unfold (crimson), each in %. Supply: Federal Reserve through FRED, writer’s calculations.

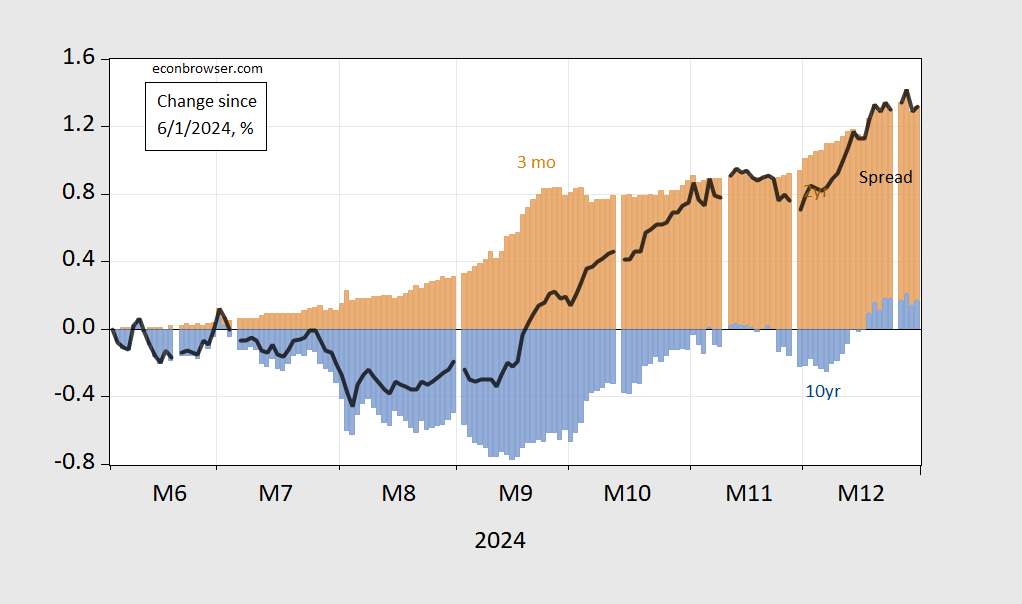

Bull or bear steepening within the 10yr-3mo? Right here’s every day information:

Determine 2: Change since June 1, 2024 in 10yr-3mo time period unfold (daring black), contribution to vary from 10 12 months yield (blue bars), from 3 month yield (tan), all in proportion factors. Supply: Treasury through FRED, and writer’s calculations.

It’s the case that almost all of the disinversion since June 1st is because of the brief fee falling, not the lengthy fee rising.

Utilizing a specification incorporating the three month change within the unfold, a probit mannequin implies 61% likelihood of recession in 2025M04, in comparison with 31% utilizing a selection solely…