That’s the title of a Timoros/WSJ article three days in the past:

Sometimes within the restoration from a downturn, households are extra cautious about spending and are more likely to save. When charges are low, borrowing helps spending. Excessive charges choke off that spending.

This time, financial exercise has been supported extra by wealth and incomes than by credit score. The pandemic altered spending habits which, along with larger asset costs, strong job prospects and authorities stimulus, left extra households feeling flush.

As I famous in a earlier recounting enterprise cycle indicators for Could/April, the reply to the above query could possibly be: (1) the recession is right here and we simply don’t see it within the preliminary information, (2) the recession continues to be coming, for the reason that timing between time period unfold inversion and recession onset is variable, (3) the mannequin we used is mistaken, (4) it’s simply luck of the draw (earlier estimates primarily based on shorter samples nonetheless didn’t point out 100% possibilities, e.g. right here).

Right here is an up to date evaluation of recession possibilities (for 12 months forward), together with information by way of Could 2024, and assuming no recession has arrived as of June 2024.

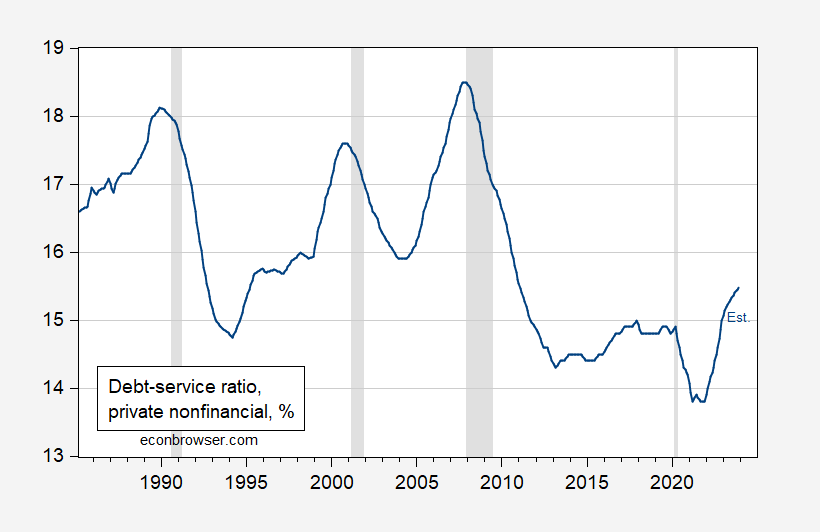

Determine 1: Probit estimated recession possibilities for 12 months forward, utilizing 10yr-3mo unfold and three month price (blue), 10yr-3mo unfold, 3 mo price, and debt-service-ratio for personal nonfinancial sector (tan), and 10yr-3mo unfold, 3 mo price, debt-service-ratio for personal nonfinancial sector, and overseas time period unfold (inexperienced). Pattern for estimation 1985M03-2024M06. NBER outlined peak-to-trough recession dates shaded grey. Supply: Creator’s calculations, and NBER.

Word that the overseas time period unfold augmented specification (an Ahmed-Chinn specification stripped of oil costs, fairness returns/volatility, and monetary situation index, augmented with debt service ratio) solely peaks at 41% for Could. The DSR augmented specification (following Chinn-Ferrara, omitting monetary situations index) produces a 24% peak recession likelihood for Could 2024. This latter specification incorporates the concept of sturdy shopper stability sheets, and the insulation of mortgage holders through fastened price mortgages, to the extent that the debt service ratio stays comparatively low.

Determine 2: Debt-service ratios for nonfinancial non-public sector, % (blue). 2023Q4 is estimated utilizing rates of interest (see right here). NBER outlined peak-to-trough recession dates shaded grey. Supply: BIS, Dora Fan Xia, NBER, and writer’s calculations.

Peak estimated possibilities are for Could 2024; we’ve got solely employment information for Could (on the month-to-month frequency).

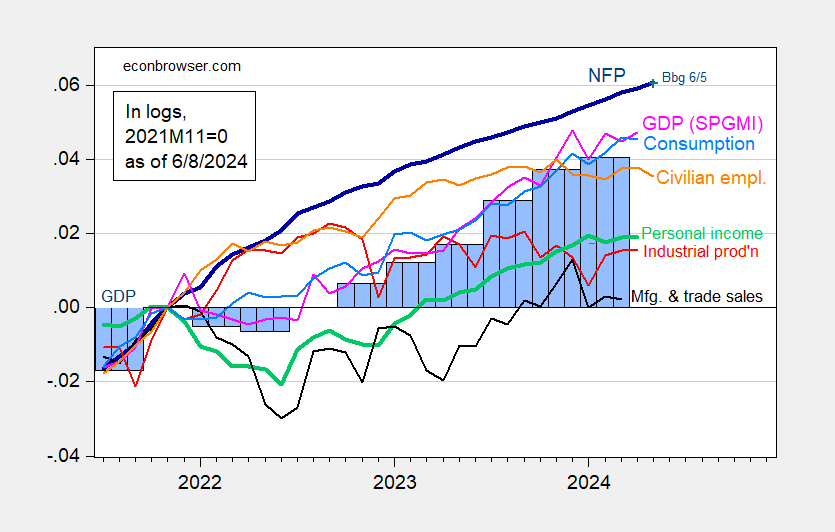

Determine 3: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (purple), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q1 second launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 launch), and writer’s calculations.

And different extra dependable indicators counsel much less strong progress, at the very least by way of finish 2023.

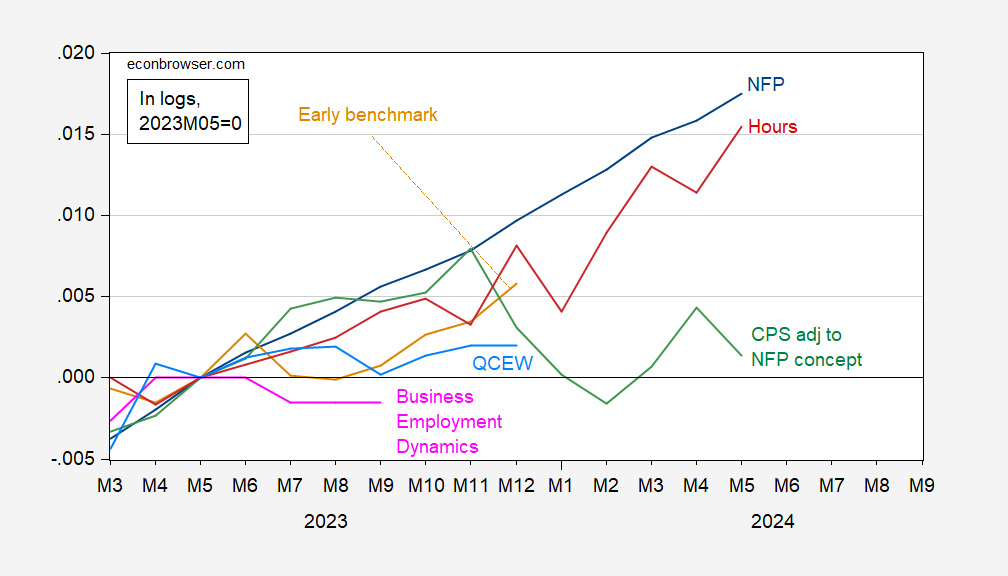

Determine 4: Nonfarm payroll employment (blue), early benchmark, calculated by adjusting precise utilizing ratio of early benchmark sum of states to CES sum of states (tan), CPS measure adjusted to NFP idea (inexperienced), QCEW complete coated employment seasonally adjusted by writer through the use of geometric shifting common (sky blue), Enterprise Employment Dynamics internet progress cumulated on 2019Q4 NFP (pink), and mixture hours (purple), all in logs, 2023M05=0. Supply: BLS, Philadelphia Fed, and writer’s calculations.