by Calculated Danger on 5/21/2024 08:20:00 AM

We’re seeing scary articles in regards to the debt once more. It’s price remembering that on the flip of the millennium, the priority was that the US was paying off the debt too shortly!

Listed here are just a few excerpts from a speech by then Fed Chair Alan Greenspan in April 2001: The paydown of federal debt

“Today I want to address a subject in which your group and the Federal Reserve share a keen interest–the paydown of the federal debt and its implications for the economy and financial markets. While the magnitudes of future federal unified budget surpluses are uncertain, they are highly likely to remain sizable for some time. …

[C]urrent forecasts suggest that under a reasonably wide variety of possible tax and spending policies, the resulting surpluses will allow the Treasury debt held by the public to be paid off. Moreover, well before the debt is eliminated–indeed, possibly within a relatively few years–it may become difficult to further reduce outstanding debt to the public because the remaining obligations will mostly consist of savings bonds, well-entrenched holdings of long-term marketable debt, and perhaps other types of debt that could prove difficult to reduce.”

What went improper over the past 20+ years?

Here’s a listing of occasions and coverage selections that considerably elevated the debt after 2000:

1) The 2000 projections had been overly optimistic.

2) The 2001 recession.

3) The 2001 and 2003 Bush Tax Cuts.

4) 9/11, Homeland Safety Spending and the Battle in Afghanistan

5) The Battle in Iraq

6) The Finacial Disaster and Nice Recession

7) The Trump Tax Cuts

8) The Pandemic.

1) Overly Optimistic Projections: Listed here are the CBO projections from July 2000: The Finances and Financial Outlook: An Replace

Click on on graph for bigger picture.

The CBO projections confirmed an virtually $6 Trillion in debt discount within the 2001 by 2010 interval.

I argued in 2000 that these projections ignored doable destructive occasions corresponding to an funding led recession because of the bursting of inventory bubble. These projections had been clearly overly optimistic.

2) The 2001 Recession: Though Greenspan talked about “the current slowdown in economic activity” in his April 2001 speech, he did not notice the economic system was already in a recession. From the Could 2000 FOMC minutes:

“The information reviewed at this meeting suggested that economic growth had remained rapid through early spring.”

The economic system was already in a recession!

3) Bush Tax Cuts: These tax cuts had been offered as slowing the expansion of the surpluses (utilizing Greenspan’s speech for canopy)! As a substitute, the tax cuts (largely for the rich) turned the surpluses into deficits and diminished income by $1.5 trillion or extra over the 2001 – 2010 interval.

4) 9/11, Homeland Safety Spending and the Battle in Afghanistan: The 9/11/2001 assaults led to a pointy improve in homeland safety spending and the Battle in Afghanistan.

5) The Battle in Iraq: The Bush administration argued the struggle would value round $80 billion. VP Dick Cheney stated on Meet the Press: “every analysis said this war itself would cost about $80 billion”. As a substitute, the struggle value properly over $1 trillion (and numerous lives had been misplaced). Word: Years in the past, I discussed on this weblog that “I opposed the Iraq war and was shouted down and called names like “Saddam lover” for questioning the veracity of the information.”

6) The Monetary Disaster and Nice Recession. This was the worst US recession for the reason that Nice Despair. This led to the primary $1 trillion annual finances deficit in US historical past and dramatically elevated the nationwide debt. The causes of the bubble had been speedy adjustments within the mortgage lending business, score businesses that did not account for these adjustments, mixed with a scarcity of regulatory oversight. I used to be speaking with subject regulators in 2005 and 2006, and so they had been all terrified. I used to be advised the appointees on the prime of the businesses had been blocking any effort to tighten requirements.

This photograph reveals John Reich (then Vice Chairman of the FDIC and later on the OTS) and James Gilleran of the Workplace of Thrift Supervision (with the chainsaw) and representatives of three banker commerce associations: James McLaughlin of the American Bankers Affiliation, Harry Doherty of America’s Group Bankers, and Ken Guenther of the Impartial Group Bankers of America.

“Not only will this tax plan pay for itself, but it will pay down debt,” Treasury Secretary Steve Mnuchin, Sept 2017

“I think this tax bill is going to reduce the size of our deficits going forward,” Sen. Pat Toomey (R-PA), November 2017

Full nonsense.

8) The Pandemic: Deficit spending elevated sharply because of the pandemic.

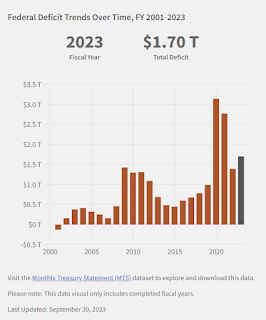

Word: This isn’t adjusted for the expansion of the economic system.

So, what occurred to “paying off the debt”? A collection of adversarial occasions (9/11, pandemic), and poor coverage selections.

Word that all of the “poor policy choices” had been by Republicans together with tax cuts, the Iraq Battle, and failure to correctly regulate previous to the good recession.

We can not at all times keep away from adversarial occasions like 9/11 and the pandemic, however I opposed every of those poor coverage selections as they occurred – so these are clearly avoidable.

These scary tales? They appear to disregard historical past.