It’s commonplace to correlate time period spreads with future financial exercise measured a method or thSo, whereas different. Recessions within the US do appear to be predictable on the idea of time period spreads; however recessions are a binary variable insofar because the NBER, ECRI, and different establishments outline it. What about progress as a steady variable — be it progress of GDP or industrial manufacturing?

Chinn and Kucko (2015) famous that the predictive energy of the 10yr-3mo unfold for industrial manufacturing progress appeared to have decreased over time, with the slope coefficient statistically important 1970-97, and never so 1998-2009. What concerning the more moderen knowledge? Utilizing quarterly knowledge 1967-2023Q3 (so for recession indicators as much as 2024Q3) a Bai-Perron sequential break check signifies a break at 1984Q2, with the slope coefficient extremely important within the early interval, and never so within the later.

What can we are saying about whether or not the slope coefficient has predictive energy for some indicators and never others. Usually, on the month-to-month frequency, the proxy for progress has been industrial manufacturing since this has been the one long-span indicator obtainable. Now, nonetheless, we’ve got a wide range of indicators, so we are able to now consider the predictive energy of the unfold (in addition to different monetary indicators) on month-to-month knowledge.

Right here, I evaluate month-to-month GDP from S&P International (previously IHS-Markit, Macroeconomic Advisers) and the Philadelphia Fed’s coincident index in opposition to industrial manufacturing. The dependent variable is the year-on-year progress fee calculated utilizing log-differences.

Determine 1: Yr-on-Yr progress fee of business manufacturing (black), of month-to-month GDP (sky blue), and coincident index (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve and Philadelphia Fed through FRED, SPGMI (Nov 1 launch), NBER, and creator’s calculations.

Word that whereas all three measures are revised over time, the month-to-month GDP and coincident indexes are considerably and repeatedly revised (similar to the quarterly official GDP collection).

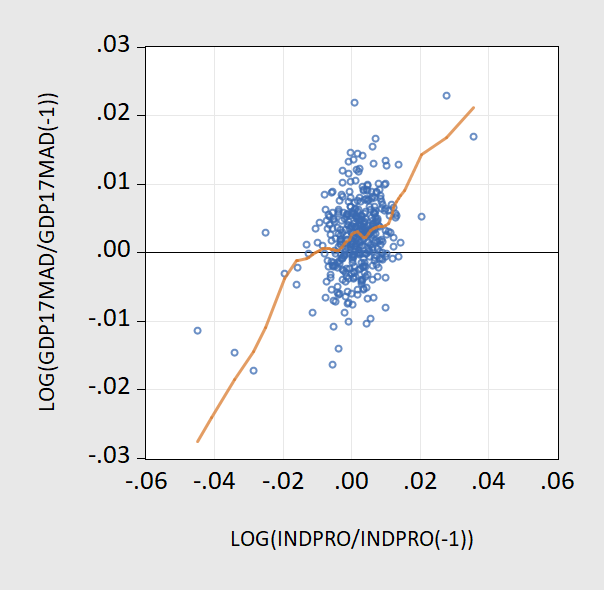

So industrial manufacturing progress deviates considerably on a y/y foundation from GDP progress; and it does so much more when taking a look at m/m, as proven in Determine 2 (the place I’ve truncated excessive actions in IP to be -6% m/m < progress < +6% m/m.

Determine 2: Scatterplot of m/m progress fee of month-to-month GDP in opposition to month-to-month industrial manufacturing, for vary of -6% m/m < IP progress < +6% m/m (blue circles), nearest neighbor match (crimson line).

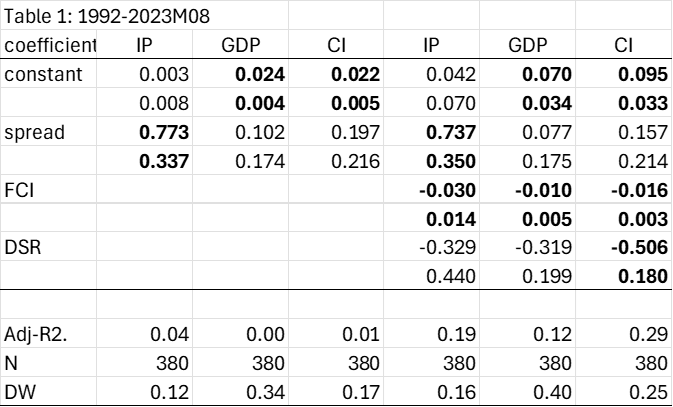

In Desk 1 are the outcomes for estimating the connection over a standard 1992-2023M08 pattern (so the final remark on the dependent variable is the y/y progress fee in 2024M08). 1992 is the place to begin as month-to-month GDP will not be obtainable sooner than that. The primary three columns report easy bivariate regressions, whereas the subsequent three increase the time period unfold with the Chicago Fed Nationwide Monetary Situations Index and the debt-service ratio (see Chinn and Ferrara (2024) for particulars of the latter, from the BIS).

Notes: Dependent variable is 12 month log distinction of business manufacturing (IP), month-to-month GDP (GDP), or coincident index (CI). unfold is the 10yr-3mo Treasury unfold in bps, FCI is Chicago Fed Nationwide Monetary Situations Index, and DSR is the debt-service ratio for personal nonfinancial sector, in decimal kind. Daring face denotes statistical significance at 5% msl, utilizing Newey-West sturdy customary errors. Supply: creator’s calculations.

The unfold is a statistically important determinant of the economic manufacturing progress fee, however the proportion of variance defined is extraordinarily low. Curiously, this discovering of a major coefficient doesn’t carry over to month-to-month GDP, or to the coincident index (which is an element primarily based on primarily labor market indicators).

If we increase the specification with FCI and DSR, these enter in considerably for IP progress. The FCI additionally enters in considerably for GDP progress and CI progress as nicely, with the distinction being the unfold will not be statistically important in both of these two circumstances. DSR is just important for the Coincident Index.

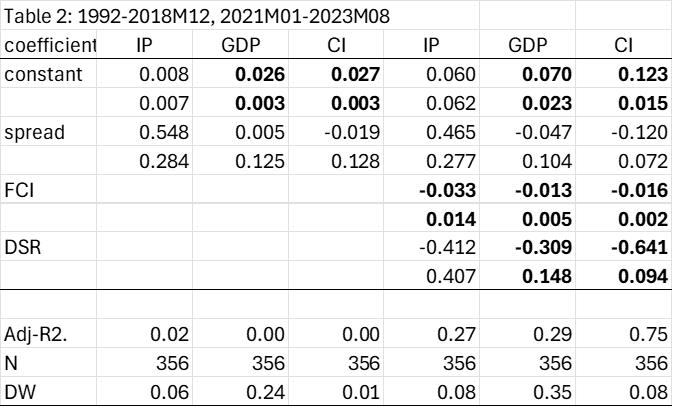

One would possibly marvel if the outcomes are being distorted by the inclusion of the pandemic interval. With a view to examine this, I drop rate of interest knowledge from 2019M01-2020M12.

Notes: Dependent variable is 12 month log distinction of business manufacturing (IP), month-to-month GDP (GDP), or coincident index (CI). unfold is the 10yr-3mo Treasury unfold in bps, FCI is Chicago Fed Nationwide Monetary Situations Index, and DSR is the debt-service ratio for personal nonfinancial sector, in decimal kind. Daring face denotes statistical significance at 5% msl, utilizing Newey-West sturdy customary errors. Supply: creator’s calculations.

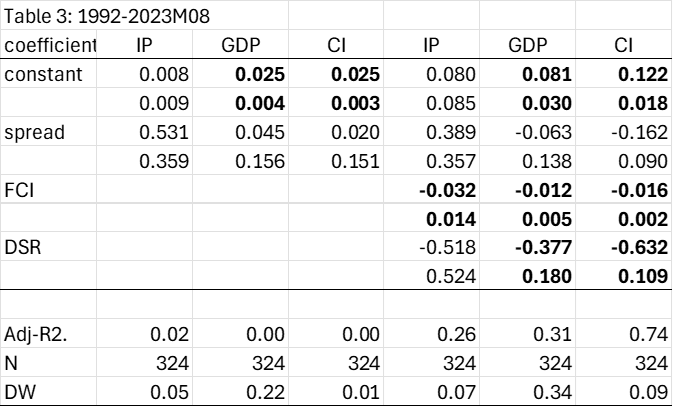

Now the unfold doesn’t enter in considerably in any specification (though it’s important on the 10% msl for the bivariate IP-spread regression). Actually, the significance of the unfold appears to be an artefact of the pandemic interval. For the pattern predating the pandemic, one obtains the next estimates.

Notes: Dependent variable is 12 month log distinction of business manufacturing (IP), month-to-month GDP (GDP), or coincident index (CI). unfold is the 10yr-3mo Treasury unfold in bps, FCI is Chicago Fed Nationwide Monetary Situations Index, and DSR is the debt-service ratio for personal nonfinancial sector, in decimal kind. Daring face denotes statistical significance at 5% msl, utilizing Newey-West sturdy customary errors. Supply: creator’s calculations.

Whereas it has been customary follow to take industrial manufacturing as a proxy for a broad combination, that is just about an expediency, fairly than one thing economically motivated. Industrial manufacturing (mining, utilities and manufacturing) accounted for less than 13% of GDP in 2023. So if one desires to research the implications of monetary indicators for combination financial exercise, it makes extra sense to focus upon GDP.

The conclusion is that the time period unfold does predict IP progress, however doesn’t predict general financial exercise, over the past thirty years. Curiously, in line the findings in Ahmed and Chinn (2024), the overseas time period unfold does predict GDP.