Immediately we’re happy to current a visitor contribution by Jamel Saadaoui (College Paris 8).

The latest literature establishes that local weather danger reduces the fiscal area, see Beirne et al. (2021) for instance. The rationale is intuitive and simple to grasp. Monetary markets will worth the impression of local weather danger within the type of increased bond yields and decrease scores on long-term international forex debt. This local weather danger premium could have vital detrimental implications for the financing of the inexperienced transition, particularly for rising markets. Nonetheless, the literature has not explored the function of economic improvement and political stability on the local weather danger premium. Intuitively, it appears cheap to suppose that nations with higher monetary methods and a extra secure political surroundings will expertise smaller pressures on their fiscal area. In a latest paper with John Beirne, Donghyun Park, Jamel Saadaoui, and Gazi Salah Uddin, we examine this situation. For a pattern of 199 economies in 1990-2022, we first empirically affirm that local weather dangers adversely have an effect on fiscal area. We discover that such results are most pronounced for economies most susceptible to local weather change. Nonetheless, our proof signifies that political stability and monetary improvement can mitigate such results. We additionally determine nonlinearities within the local weather risk-fiscal area nexus. Extra particularly, the impression of local weather danger on fiscal area is bigger when fiscal area is most constrained, i.e., on the higher quantile of the distribution.

Determine 1. Warmth plot for the low vulnerability rating.

To measure local weather danger, we use the ND-GAIN Vulnerability scores. These scores are forward-looking artificial measures of vulnerability to local weather change. Within the Figures 1 and a pair of, we will see that nations situated in sub-Saharan Africa and in South Asia are probably the most susceptible to local weather dangers. Together with the presence of extra superior nations in Determine 1, we discover a number of nations that don’t belong to the group of the extra superior economies when it comes to financial improvement. These nations have low vulnerability rating (i.e., the next resilience to local weather dangers) resulting from wonderful scores in some sub-categories of the ND-GAIN general vulnerability rating, just like the infrastructure high quality or the power autonomy sub-categories.

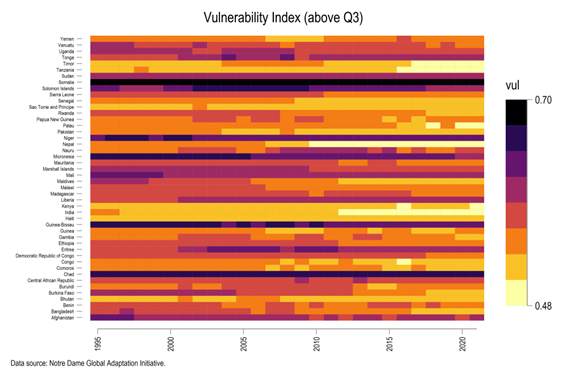

Determine 2. Warmth plot for the excessive vulnerability rating.

In Determine 2, we will observe that nations which have the next vulnerability (above the third quartile). These are nations which are usually on the decrease levels of financial and institutional improvement. These nations additionally are likely to have much less developed home monetary markets. Comparatively to the group of nations offered in Determine 1, this group of nations is extra homogenous. We discover nations in sub-Saharan Africa and South Asia. In these nations, the paved highway protection, the electrical energy entry and the entry to dependable ingesting water stay scare. For instance, Chad and Afghanistan have very excessive vulnerability scores in each the agricultural capability and the medical employees protection.

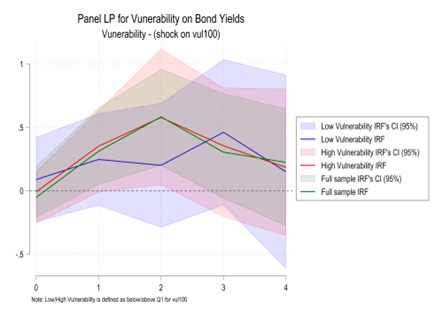

In Determine 3, we use Panel Native projections and an inventory of home and international controls in keeping with the literature. Our baseline case throughout all nations signifies a statistically important premium on sovereign bond yields resulting from local weather danger vulnerability, reflecting the excess return demanded by buyers for holding that debt. Additional, we break up the pattern between high and low local weather danger vulnerability, relying on the worth of the vulnerability rating. For the much less climate-vulnerable nations, a statistically important impact will not be discovered. That is in keeping with financial instinct, i.e., low ranges of local weather publicity won’t result in climate-related premia on sovereign bonds. For nations which might be extremely uncovered to local weather change, the impression on bond yields is critical, as anticipated. Curiously, the impact is broadly in keeping with that for the panel as an entire when it comes to magnitude, suggesting that the nations which might be extremely susceptible to local weather change could also be driving the general outcomes.

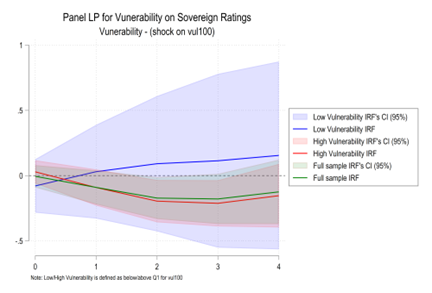

In Determine 4, we carry out the identical baseline evaluation for sovereign scores, our second measure of the fiscal area. We discover a constant outcome to that carried out on bond yields, whereby a local weather vulnerability shock will result in a persistent lower within the sovereign scores for the total pattern and the extremely climate-vulnerable nations. For the much less susceptible nations, we don’t observe such a persistent deterioration in sovereign scores, as anticipated.

Determine 3. Panel LP for the impression of vulnerability on bond yields.

Determine 4. Panel LP for the impression of vulnerability on sovereign scores.

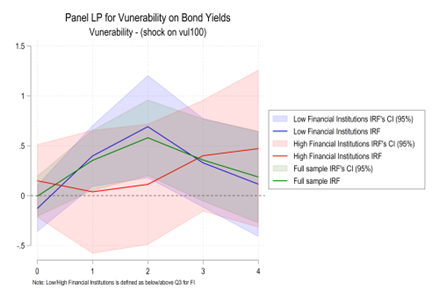

In Determine 5, we use the Monetary Establishment Improvement index (Svirydzenka, 2016) to research the affect of economic establishment improvement on the impression of vulnerability shocks on the fiscal area. For nations with mature monetary establishments, local weather vulnerability shocks don’t set off any enhance within the bond yields.

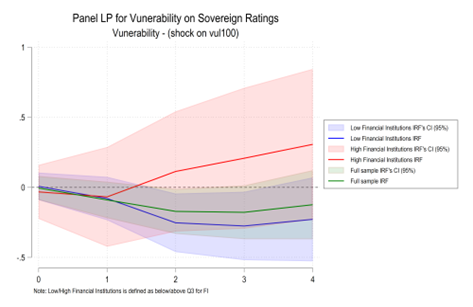

In Determine 6, we will see that local weather vulnerability shocks wouldn’t have any important impression on sovereign scores for nations with elevated ranges of economic establishment improvement. However, local weather vulnerability shocks provoke a persistent deterioration in sovereign scores for the nations with low monetary establishments and for the total pattern, underlying the significance of sound monetary establishments. The mitigating impression of enhanced monetary improvement on the climate-fiscal nexus follows instinct, whereby there may be higher depth and liquidity in native monetary markets and insurance coverage markets are higher developed.

Determine 5. Panel LP for the impression of vulnerability on bond yields (Monetary Establishments)

Determine 6. Panel LP for the impression of vulnerability on sovereign scores (Monetary Establishments)

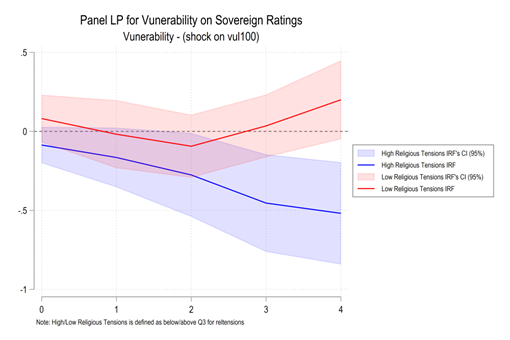

Our outcome, utilizing ICRG knowledge (PRS group), affirm our primary instinct for a number of dimensions of political stability (Exterior battle, Inner battle, Authorities stability, Ethnic tensions). Nations with extra secure political methods skilled a smaller local weather danger premium. Remarkably, the local weather danger premium is everlasting just for one dimension of political stability, which is the non secular tensions. These outcomes might assist the policymakers to grasp the function of political stability and monetary improvement within the funding of the ecological transition.

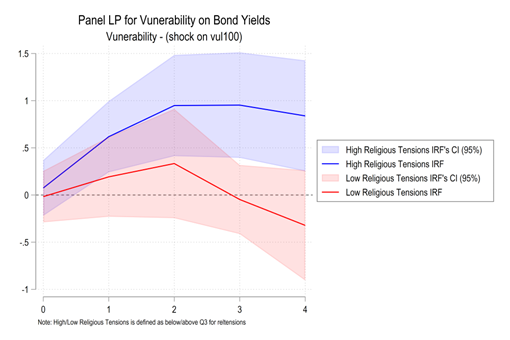

Determine 7. Panel LP for the impression of vulnerability on bond yields (Non secular Tensions)

Determine 8. Panel LP for the impression of vulnerability on sovereign charges (Non secular Tensions)

This put up written by Jamel Saadaoui.