At present, we’re happy to current a visitor contribution written by Joshua Aizenman (College of Southern California) and Jamel Saadaoui (Université Paris 8-Vincennes). This submit relies on the paper of the identical title.

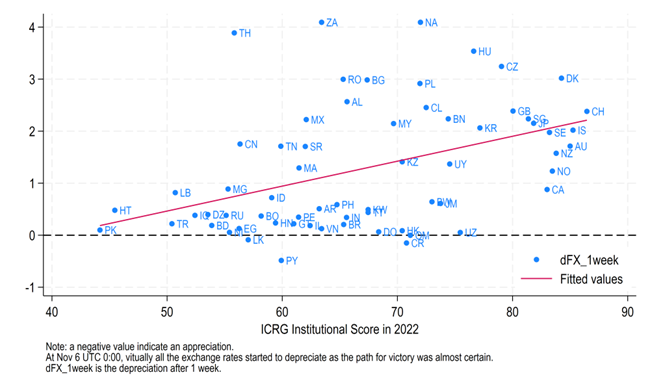

The end result of the 2024 US presidential election has resonated all world wide. On the trade fee markets, nearly all of the trade charges of nations that aren’t pegged depreciated towards the USD round midnight November 6, 2024, when the end result of the election was sure. To know higher the elements accounting for these depreciations, we compute three measures of trade fee depreciations: first, the utmost depreciation in the course of the 1st buying and selling day after November 6 UTC 0:00 to seize the response on the FOREX instantly after the information the utmost depreciation in the course of the first buying and selling day; second, the depreciation after 4 days to seize the response of financial authorities and monetary markets to the shock; third, the depreciation 1 week after the shock to watch whether or not some trade charges skilled an extra depreciation or a return to the pre-shock trade fee stage. Determine 1 plots the patterns of those 3 depreciations. Notably, the trade fee motion noticed instantly after the 2024 US election has not been reversed one week later. In 26 international locations out of a pattern of 73 bilateral trade charges towards the US Greenback, the depreciation after 1 week was much more pronounced than simply after the election. Amongst them, we discover South Africa, Thailand, Hungary, Czech Republic, Romania, Bulgaria, and Poland, because the international locations with the most important variations. These actions are on the coronary heart of policymakers’ discussions, as they create instability, particularly for rising markets.

Determine 1. Alternate fee actions within the aftermath of the 2024 US election

The end result of the 2024 US election affords us a quasi-natural experiment to check the resilience of nations to exchange-rate market pressures. Certainly, because of the nature of the Republican platform and because of the usage of high-frequency knowledge, we are able to determine the elements that specify the cross-sectional variations in foreign money returns towards the US Greenback. In Determine 2, we plot the trade fee actions towards the USD one week after the information towards the ICRG institutional rating, a broad measure of the standard of establishments created and maintained by the PRS group. For our pattern of 73 currencies towards the USD, we discover that the correlation between the depreciation fee and the institutional rating is clearly optimistic round 40 %, and important on the 1 % stage. This correlation might point out that the market expects that the brand new US administration will likely be extra favorable or at the very least extra impartial vis-à-vis international locations with political regimes which might be much less cautious about a number of dimensions of institutional growth, just like the respect of property rights, the central financial institution independence, the transparency of financial and monetary coverage, democratic accountability of the financial coverage selections and so forth.

Determine 2. Correlation between establishments and trade fee actions

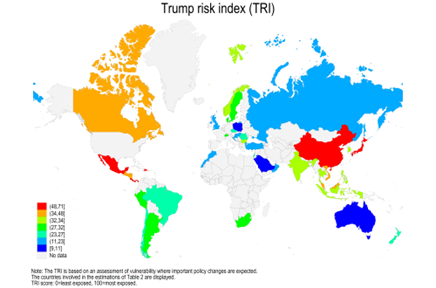

As a way to obtain extra dependable estimates, we run multivariate regressions, controlling for a vector of related confounding variables. Desk 1 affords a number of insights. First, international locations with higher establishments expertise stronger depreciation. Second, trade fee interventions (proxied by trade fee stability scores) have helped to stabilize the currencies in any respect time horizons. Third, misalignment of the actual efficient trade fee contributes to the trade fee depreciation solely after 4 days. This coefficient can mirror an error-correction mechanism, as overvalued currencies are anticipated to depreciate sooner or later. Fourth, the bilateral commerce surplus with the US contributed to the depreciation after 4 days. Larger publicity to the chance linked to anticipated adjustments within the US coverage, measured by the EIU’s Trump Danger Index (see Determine 3), contributes to limiting the depreciation after 4 days. This presumably displays the statement that the majority uncovered economies have skilled the most important actions instantly after the shock (according to dynamics instructed by Larson and Madura, 2001. ‘Overreaction and underreaction in the foreign exchange market.’ World Finance Journal).

Determine 3. The Trump Danger index

Supply:The Economist.

This submit written by Joshua Aizenman and Jamel Saadaoui.