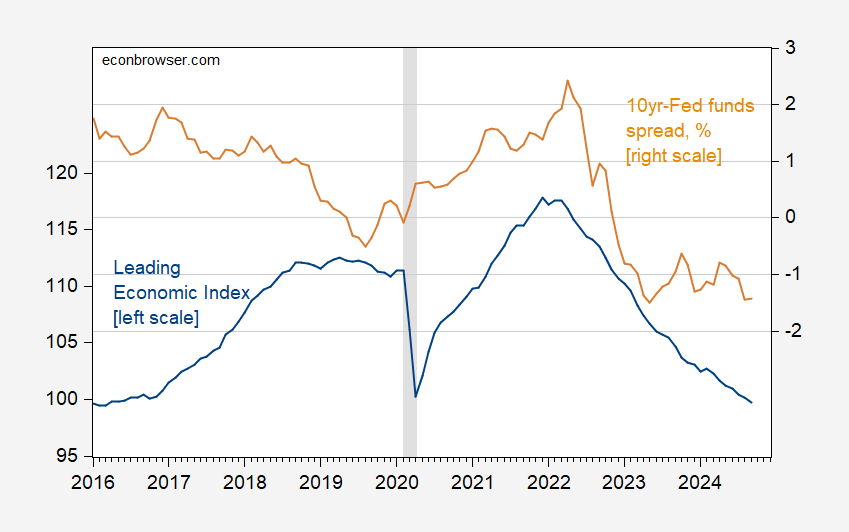

I’ve up to date the “regression camp” membership listing. Assuming no recession exhibits up (hear Cam Harvey speak concerning the challenge), what can we take from the Convention Board’s Main Financial Index returning to recession territory (it’s spent a lot of the final 18 months there):

The very first thing to notice is that the LEI consists of (like many monetary situations indexes) the time period unfold in some kind. So when the LEI is declining, a part of it (I don’t know precisely how a lot) is because of modifications within the time period unfold.

Determine 1: Convention Board Main Financial Index (blue, left scale), and 10yr-Fed funds unfold, % (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: Convention Board through TradingEconomics.com, US Treasury, Federal Reserve through FRED, NBER.

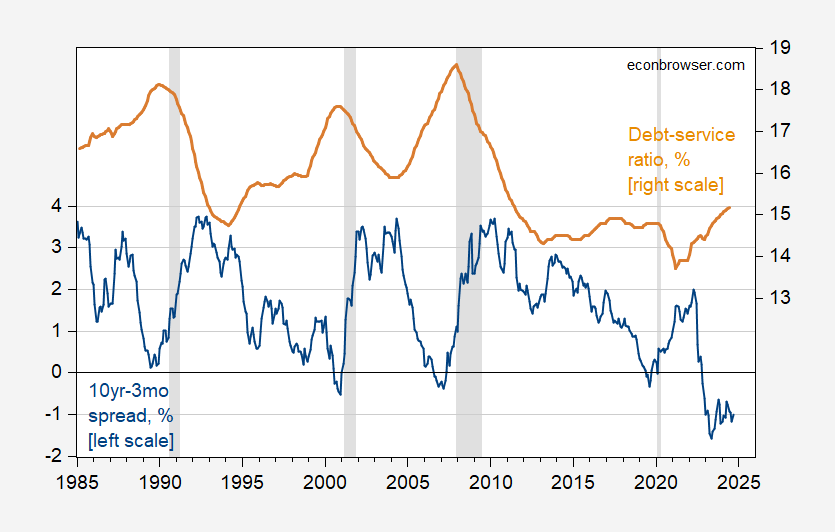

Right here’s the relevance of this level. The time period unfold unfold (with 3 month charge fairly than Fed funds charge) signifies a 40% likelihood in October, 58% final Could. So both the historic correlation has damaged down, a recession will hit quickly (or has already and we don’t understand it). Maybe an necessary variable has been omitted. Per Chinn and Ferrara (2024), we argue for the personal nonfinancial sector debt-service ratio.

Determine 2: 10 year-3 month Treasury time period unfold (blue, left scale), and personal nonfinancial sector debt-service ratio (tan, proper scale), each in %. 2024Q2 debt-service ratio extrapolated utilizing lagged values of modifications in debt service ratio, the three month Treasury yield, AAA charge. DSR interpolated from quarterly to month-to-month utilizing linear interpolation. NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, BIS, NBER.

Apparently, debt-service has been comparatively low, in comparison with earlier recessions.

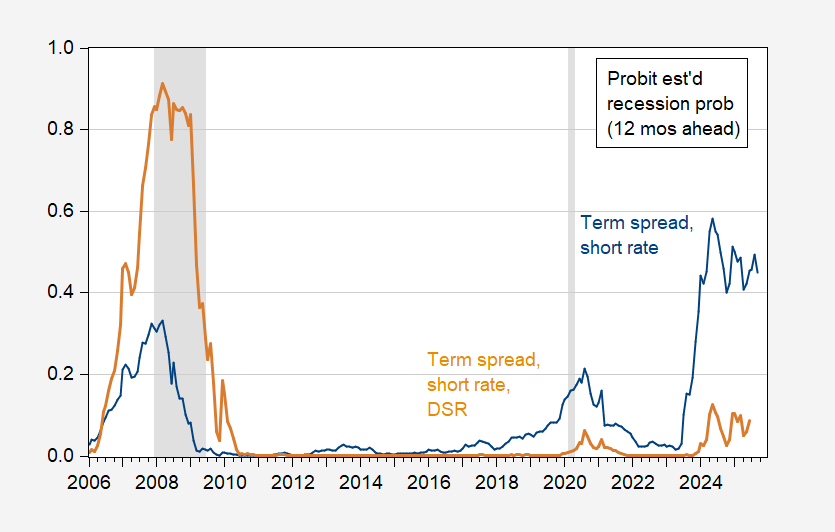

A time period unfold – debt service augmented mannequin (see this submit) exhibits a a lot decrease likelihood of recession, whereas offering a a lot better match for the 2008-09 recession.

Determine 3: Estimated 12 month forward chances of recession, from probit regression on time period unfold and brief charge, 1986-2024 (blue), on time period unfold, brief charge and debt-service ratio (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, BIS, NBER, and creator’s calculations.