Previously few years, a persistently low degree of client sentiment, as measured by the College of Michigan, Convention Board, or Gallup surveys, relative to standard financial measures has puzzled analysts, together with this one [1] [2] [3] [4] [5]. This puzzle is illustrated by the evolution of the U. Michigan sequence (FRED sequence UMCSENT), and the fitted values utilizing 2011M01-2024M08 knowledge on unemployment and year-on-year inflation.

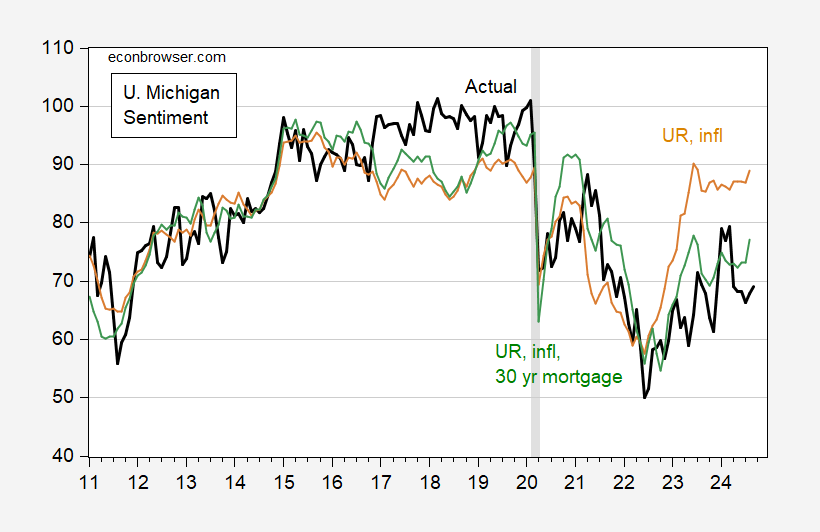

Determine 1: College of Michigan Shopper Sentiment index (daring black), fitted values utilizing unemployment and inflation (see textual content) (tan), +/- 1 commonplace error band (grey line). NBER outlined peak-to-trough recession dates shaded grey. Supply: College of Michigan by way of FRED, NBER, and writer’s calculations.

Right here’s the regression outcomes (the place inflation is 12 month progress fee, in %):

UMCSENT = 104.12 –2.455 UNRATE – 3.727 INFL

Adj-R2 = 0.51, SER 9.256, DW = 0.23, N=164, Pattern 2011M01-2024M08. Daring denotes significance at 10% degree utilizing HAC Newey-West commonplace errors.

Peak hole is in mid-2023 and end-2023.

Partial decision is proven within the following image, motivated by Bolhuis et al (2024).

Determine 2: College of Michigan Shopper Sentiment index (daring black), fitted values utilizing unemployment and inflation (tan), utilizing unemployment, inflation, and 30 yr mortgage fee (inexperienced). NBER outlined peak-to-trough recession dates shaded grey. Supply: College of Michigan by way of FRED, NBER, and writer’s calculations.

The inexperienced line is the match utilizing the baseline equation augmented with 30 yr mortgage charges.

UMCSENT = 135.67 –3.669 UNRATE – 3.328 INFL – 5.97 MORTGAGE30US

Adj-R2 = 0.73, SER 6.785, DW = 0.48, N=164, Pattern 2011M01-2024M08. Daring denotes significance at 10% degree utilizing HAC Newey-West commonplace errors.

The place MORTGAGE30US is the FRED sequence for the 30 yr mortgage fee within the US. Observe that in each regressions, I’ve used HICP (which doesn’t embody housing prices) as my value index. The mortgage fee is nearly as necessary because the unemployment fee, in accordance with standardized (beta) coefficients (0.53 vs. 0.58, and 0.62 for inflation).

These outcomes point out {that a} 1.1 proportion level decline in MORTGAGE30US for the reason that October 2023 peak (through August) has accounted for an roughly 6.5 level enhance in UMCSENT.

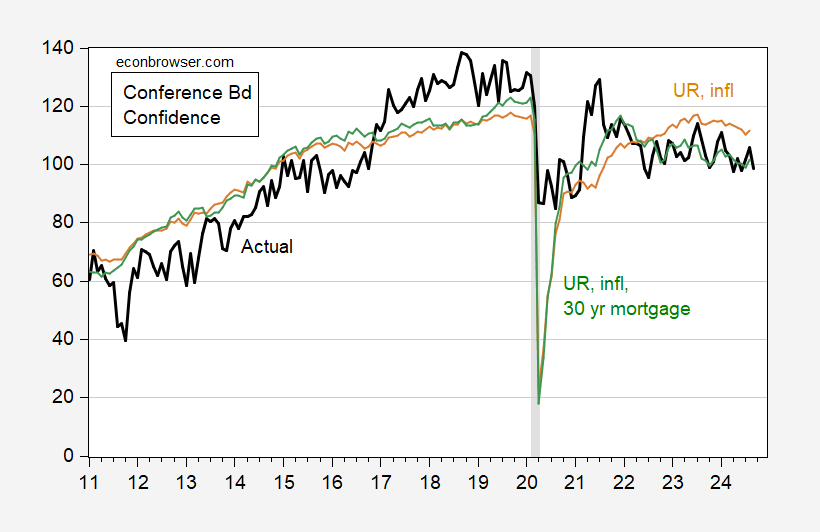

Related outcomes are exhibited by the Convention Board’s Shopper Confidence index (though HICP y/y inflation doesn’t present up as statistically vital):

Determine 3: Convention Board Shopper Confidence Index index (daring black), fitted values utilizing unemployment and inflation (tan), utilizing unemployment, inflation, and 30 yr mortgage fee (inexperienced). NBER outlined peak-to-trough recession dates shaded grey. Supply: Convention Board by way of Investing.com, NBER, and writer’s calculations.

The regression outcomes are:

CONFIDENCE_CONFBD = 175.28 –9.544 UNRATE – 0.716 INFL – 4.984 MORTGAGE30US

Adj-R2 = 0.63, SER 13.640, DW = 0.40, N=164, Pattern 2011M01-2024M08. Daring denotes significance at 10% degree utilizing HAC Newey-West commonplace errors.

Why is that this solely a potential decision? If one extends the pattern earlier than 2011M01, the regression outcomes crumble. Inclusion of MORTGAGE30US then yields a constructive coefficient, insignificant at first, and vital because the pattern extends additional again in time (see e.g. 1991M01-2024M08; one can use CPI ex-shelter as an extended sequence for costs). Since this instability within the relationship isn’t related to the change in together with housing prices within the CPI as famous by Bolhuis et al (2024), I consider this as a remaining puzzle. Maybe if housing costs have been additionally included, this might treatment the issue (truly, I’ve checked – it type of does).

Lastly, word that mortgage charges enter asymmetrically into UMCSENT for Democrats vs. Republicans. Mortgage charges have an insignificant impression for Democrats’ sentiment. A Trump dummy dominates for each Republicans and Democrats, when it comes to affect as measured by a standardized coefficient. Therefore, the inclusion of mortgage charges don’t clarify all of the seemingly anomalous conduct of sentiment indices.