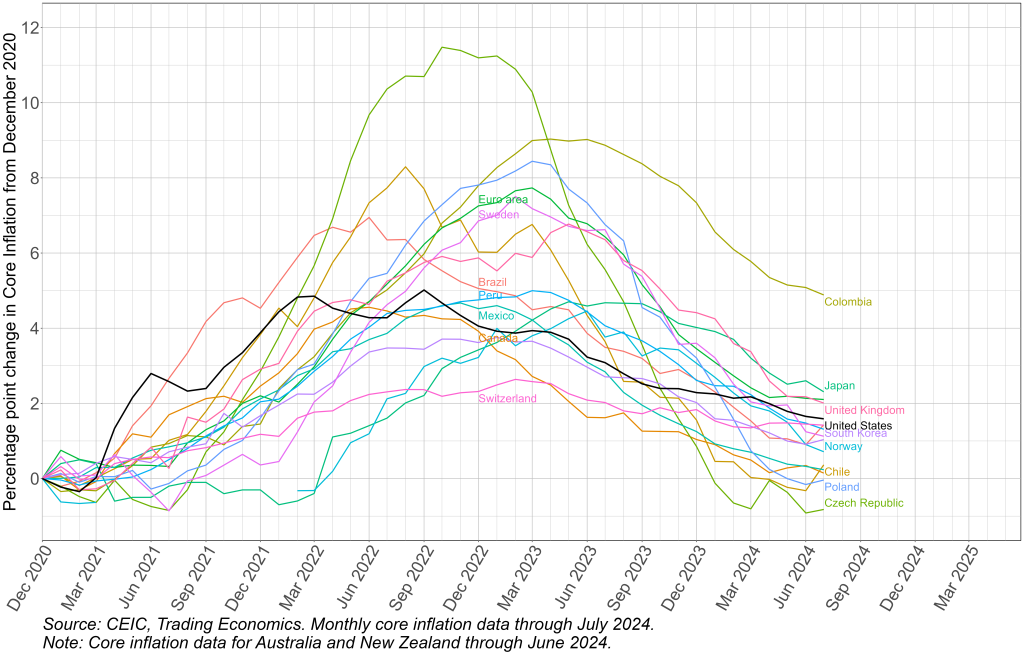

From the article (printed 9/10), two key graphs:

So…

…with inflation practically down to focus on ranges whereas indicators of financial slowing mount, the Fed can afford to begin reversing its distinctive financial tightening.

So in immediately’s put up, Kamin makes the case for 0.5% reduce:

If the economic system is near stability and inflation more likely to decline additional, then rates of interest must also be at regular ranges. Economists refer to those as “neutral” charges, which implies “the short-term interest rate that would prevail when the economy is at full employment and stable inflation.” Impartial rates of interest can’t be straight noticed, however cheap estimates would focus on three %: two % to compensate buyers for inflation and an extra one % to mirror actual returns to capital. In reality, within the projections final launched in June, Fed officers put that price at 2.8 %.

So, with inflation largely contained and the economic system basically in stability, rates of interest must be nearer to a few % than 5 %. And even when there may be larger power within the economic system than most economists decide, or if impartial rates of interest are increased, there may be nonetheless a really sizeable cushion between the place rates of interest are and the place they have to be. Which means even a 0.5 % price reduce might be made with little danger of re-igniting inflation.