by Calculated Danger on 4/27/2024 08:11:00 AM

The important thing report scheduled for this week is the April employment report.

Different key studies embrace February Case-Shiller home costs, April car gross sales, and the March commerce steadiness.

The FOMC meets this week and no change to coverage is anticipated.

For manufacturing, the April Dallas Fed manufacturing survey, and the ISM index shall be launched.

—– Monday, April twenty ninth —–

10:30 AM: Dallas Fed Survey of Manufacturing Exercise for April.

—– Tuesday, April thirtieth —–

9:00 AM: S&P/Case-Shiller Home Worth Index for February.

This graph exhibits the nominal seasonally adjusted Nationwide Index, Composite 10 and Composite 20 indexes by way of the latest report (the Composite 20 was began in January 2000).

The consensus is for a 6.7% year-over-year enhance within the Comp 20 index for February.

9:00 AM: FHFA Home Worth Index for February. This was initially a GSE solely repeat gross sales, nevertheless there may be additionally an expanded index.

9:45 AM: Chicago Buying Managers Index for April. The consensus is for a studying of 45.0, up from 41.4 in March.

10:00 AM: the Q1 2024 Housing Vacancies and Homeownership from the Census Bureau.

—– Wednesday, Could 1st —–

7:00 AM ET: The Mortgage Bankers Affiliation (MBA) will launch the outcomes for the mortgage buy functions index.

8:15 AM: The ADP Employment Report for April. This report is for personal payrolls solely (no authorities). The consensus is for 180,000 payroll jobs added in April, down from 184,000 added in March.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for the ISM to be at 50.1, down from 50.3 in March.

10:00 AM: Development Spending for March. The consensus is for a 0.3% enhance in development spending.

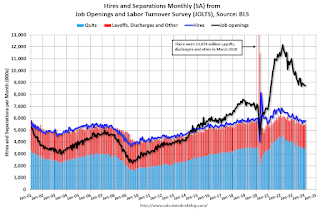

This graph exhibits job openings (black line), hires (darkish blue), Layoff, Discharges and different (purple column), and Quits (gentle blue column) from the JOLTS.

Jobs openings have been little modified in February at 8.76 million from 8.75 million in January.

The variety of job openings (black) have been down 11% year-over-year in February.

2:00 PM: FOMC Assembly Announcement. No change to coverage is anticipated at this assembly.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

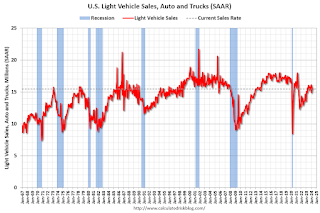

This graph exhibits gentle car gross sales for the reason that BEA began retaining information in 1967. The dashed line is the gross sales price for the earlier month.

—– Thursday, Could 2nd —–

8:30 AM: The preliminary weekly unemployment claims report shall be launched. The consensus is for 210 thousand preliminary claims, up from 207 thousand final week.

This graph exhibits the U.S. commerce deficit, with and with out petroleum, by way of the latest report. The blue line is the full deficit, and the black line is the petroleum deficit, and the purple line is the commerce deficit ex-petroleum merchandise.

The consensus is the commerce deficit to be $68.8 billion. The U.S. commerce deficit was at $68.9 billion in February.

—– Friday, Could third —–

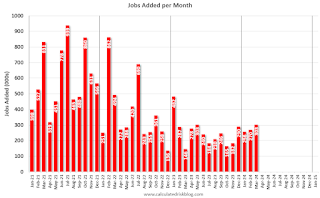

8:30 AM: Employment Report for April. The consensus is for 210,000 jobs added, and for the unemployment price to be unchanged at 3.8%.

8:30 AM: Employment Report for April. The consensus is for 210,000 jobs added, and for the unemployment price to be unchanged at 3.8%.

There have been 303,000 jobs added in March, and the unemployment price was at 3.8%.

This graph exhibits the roles added monthly since January 2021.

10:00 AM: the ISM Companies Index for April. The consensus is for a studying of 52.0, up from 51.4.