The Bureau of Financial Evaluation introduced at present that seasonally adjusted U.S. actual GDP grew at a 1.6% annual fee within the first quarter. That’s a little bit decrease than many analysts anticipated. However the year-over-year progress continues to be on monitor.

Prime panel: quarterly actual GDP progress at an annual fee, 1947:Q2-2024:Q1, with the historic common (3.1%) in blue. Calculated as 400 occasions the distinction within the pure log of actual GDP from the earlier quarter. Backside panel: year-over-year progress fee. Calculated as 100 occasions the distinction within the pure log of actual GDP from the identical quarter of the earlier yr.

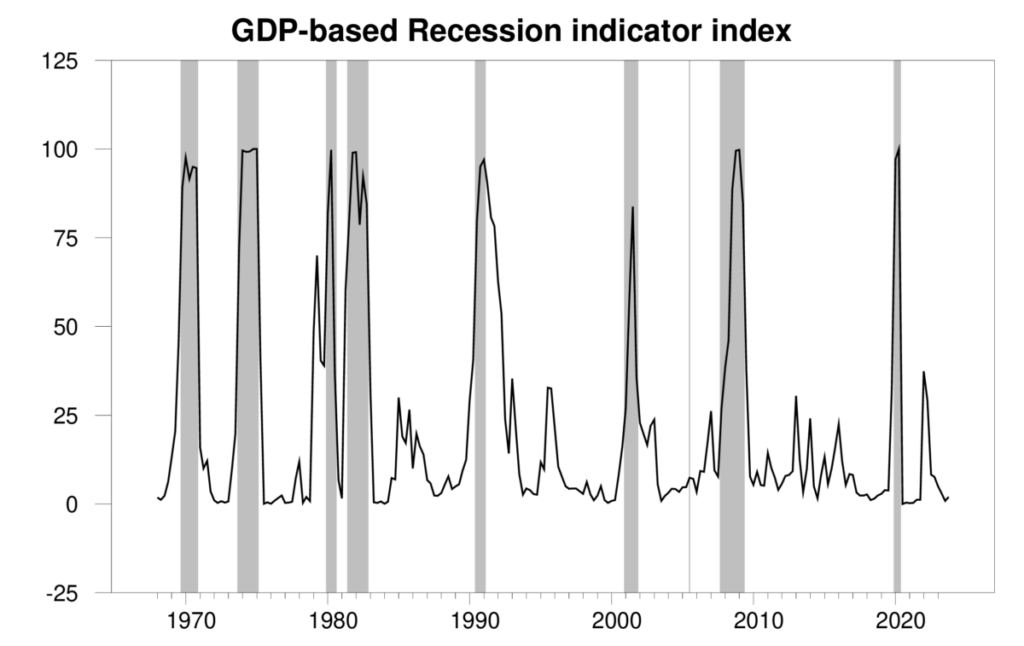

The brand new numbers put the Econbrowser recession indicator index at 2.0%, a really low stage, indicating unambiguous continuation of the financial growth that started in 2020:Q3.

GDP-based recession indicator index. The plotted worth for every date relies solely on the GDP numbers that have been publicly accessible as of 1 quarter after the indicated date, with 2023:This fall the final date proven on the graph. Shaded areas characterize the NBER’s dates for recessions, which dates weren’t utilized in any means in setting up the index.

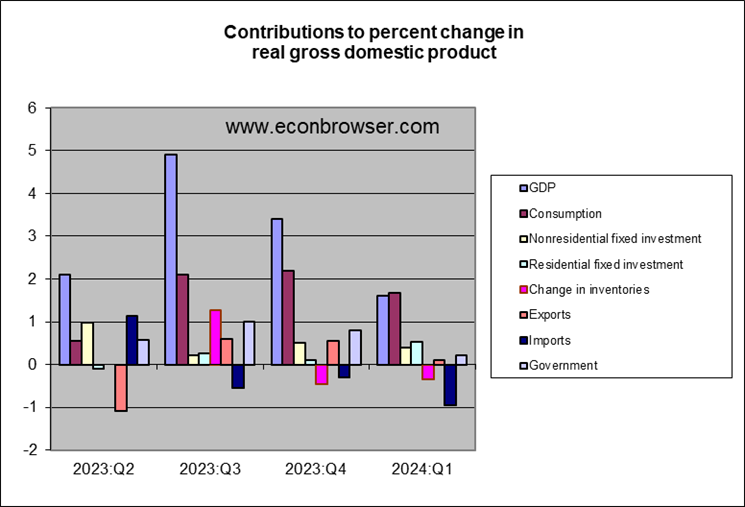

A key issue within the weaker GDP progress was a surge in imports, that are subtracted in calculating GDP. The import estimates are risky and may be topic to revision.

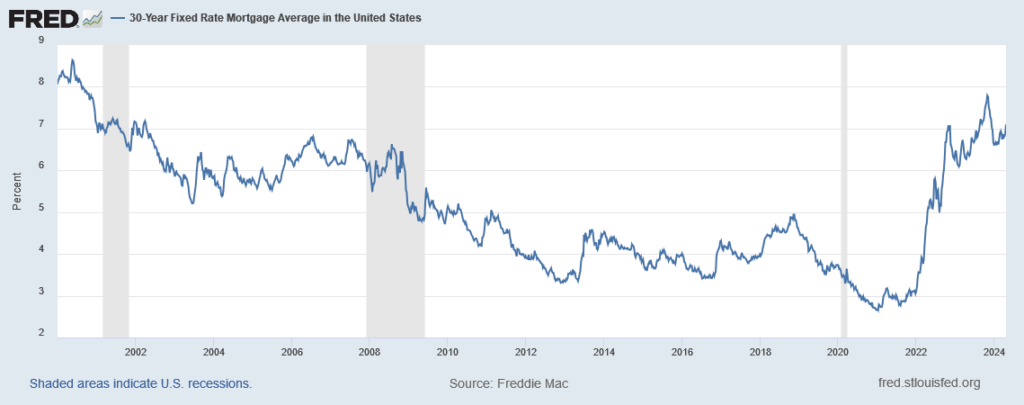

Residential mounted funding made a pleasant contribution to Q1 GDP progress, regardless of excessive rates of interest. Mortgage charges had come down between November and February however have moved partly again up since then.

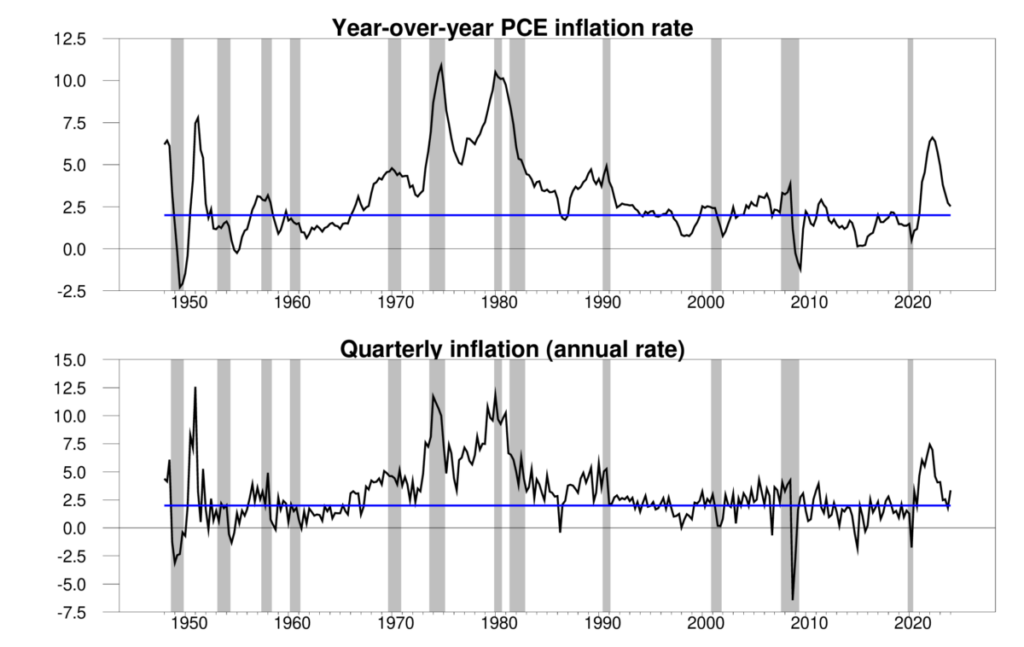

The reason for the current uptick in mortgage charges is that the Fed has not made as a lot progress at bringing inflation down as many had hoped. The brand new GDP report is a little bit disappointing there as properly. The implicit PCE deflator elevated at a 3.3% annual fee within the first quarter. The year-over-year fee was 2.5% — a little bit higher than the quarterly improve, however nonetheless above the Fed’s 2% goal.

Prime panel: 100 occasions the distinction within the pure log of the implicit value deflator on private consumption expenditures from the identical quarter of the earlier yr. Backside panel: 400 occasions the distinction within the pure log of the PCE deflator from the worth the earlier quarter.

The absence of additional progress on inflation has resulted in an enormous shift in market expectations in regards to the Fed’s subsequent strikes. Initially of December 2023, the futures contract for the December 2024 fed funds fee was 4.3%, per 4 25-basis-point cuts within the fed funds fee this yr. Proper now the contract implies a 5% fee in December. Merchants are actually anticipating just one reduce, and that not coming till later within the yr.

A number of supply-side components even have the potential to bump up the inflation fee. The 2 presidentical candidates appear to be competing to see who will improve the costs of imported items probably the most. Geopolitical riks may deliver larger power costs. And measures like California’s $20 minimal wage for fast-food staff can’t assist.

It continues to look that the Federal Reserve has carried off the coveted “soft landing,” bringing inflation down with no recession. However I’ve to confess that the aircraft is just not fairly on the bottom simply but.