by Calculated Danger on 5/08/2024 07:00:00 AM

From the MBA: Mortgage Purposes Enhance in Newest MBA Weekly Survey

Mortgage purposes elevated 2.6 % from one week

earlier, in keeping with information from the Mortgage Bankers Affiliation’s (MBA) Weekly Mortgage Purposes

Survey for the week ending Could 3, 2024.The Market Composite Index, a measure of mortgage mortgage utility quantity, elevated 2.6 % on

a seasonally adjusted foundation from one week earlier. On an unadjusted foundation, the Index elevated 3

% in contrast with the earlier week. The Refinance Index elevated 5 % from the earlier

week and was 6 % decrease than the identical week one yr in the past. The seasonally adjusted Buy

Index elevated 2 % from one week earlier. The unadjusted Buy Index elevated 2 %

in contrast with the earlier week and was 17 % decrease than the identical week one yr in the past.“Treasury charges and mortgage charges fell final week on the information of a slowing job market, with wage development

on the slowest tempo since 2021, and the Federal Reserve’s introduced plans to ease quantitative

tightening in June and to take care of its view that one other price hike is unlikely. The standard 30-year price

dropped 11 foundation factors, and the FHA price fell 17 foundation factors to six.92 %, again beneath 7% for the primary

time in three weeks,” stated Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Mortgage

purposes elevated for the primary time in three weeks, with refinances up 5 %. Even with the

enhance, which included a 29 % bounce in VA refinances, refinance utility quantity stays about

6 % beneath final yr’s already low ranges.”Added Kan, “Driven by a 5 percent gain in FHA applications, purchase activity was up 2 percent. First-time homebuyers account for roughly half of purchase loans, and the government lending programs are an important source of financing for these homebuyers. The gain in FHA activity is a sign that this segment of the market is active.”

…

The typical contract rate of interest for 30-year fixed-rate mortgages with conforming mortgage balances

($766,550 or much less) decreased to 7.18 % from 7.29 %, with factors unchanged at 0.65 (together with

the origination price) for 80 % loan-to-value ratio (LTV) loans.

emphasis added

Click on on graph for bigger picture.

The primary graph exhibits the MBA mortgage buy index.

In keeping with the MBA, buy exercise is down 17% year-over-year unadjusted.

Purple is a four-week common (blue is weekly).

Buy utility exercise is up barely from the lows in late October 2023, and beneath the bottom ranges in the course of the housing bust.

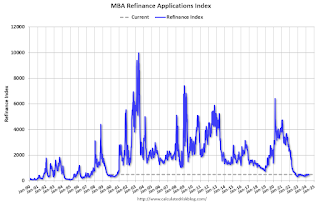

With larger mortgage charges, the refinance index declined sharply in 2022, and has largely flat lined since then.