EJ Antoni (Heritage) is doubtful about GDPNow’s (and different nowcasts) relating to Q3 development. From X aka Twitter at the moment:

I questioned about this, in mild of the measured acceleration of actual consumption development (m/m AR 4.6% in July). GDPNow stories nowcasted development of parts, like consumption so one can verify the nowcast. GDPNow’s 30 August has a 3.8% q/q AR development price penciled in. What’s the image appear like?

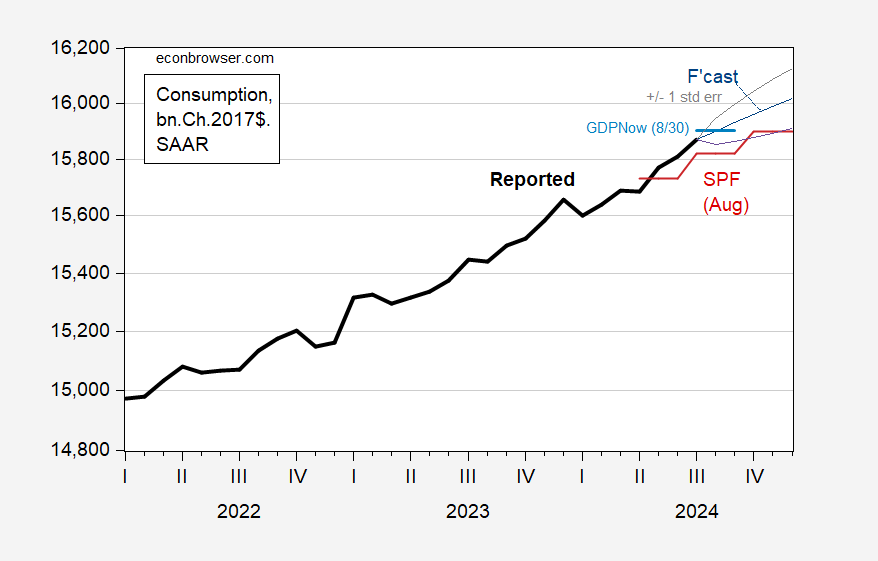

Determine 1: Consumption (daring black), GDPNow nowcast as of 30 Aug (blue line), August SPF median (pink line), and ARIMA(0,1,0) forecast (blue line), +/- 1 normal error band (grey strains), all in bn.Ch.2017$, SAAR, log scale. Forecast estimated in log first variations, 2021M07-2024M07. Supply: BEA, Philadelphia Fed, Atlanta Fed, and writer’s calculations.

Admittedly, GDPNow’s nowcasted consumption is above the August SPF median (though this forecast was generated in early August). Nevertheless, based mostly completely on a easy autoregressive mannequin, 3.8% q/q AR consumption development wouldn’t be shocking in any respect, statistically talking.