CNN revealed an article at the moment, entitled “What’s really happening in America’s economy”. Most factors are standard, however one graph was attention-grabbing – bank card debt:

Supply: CNN.

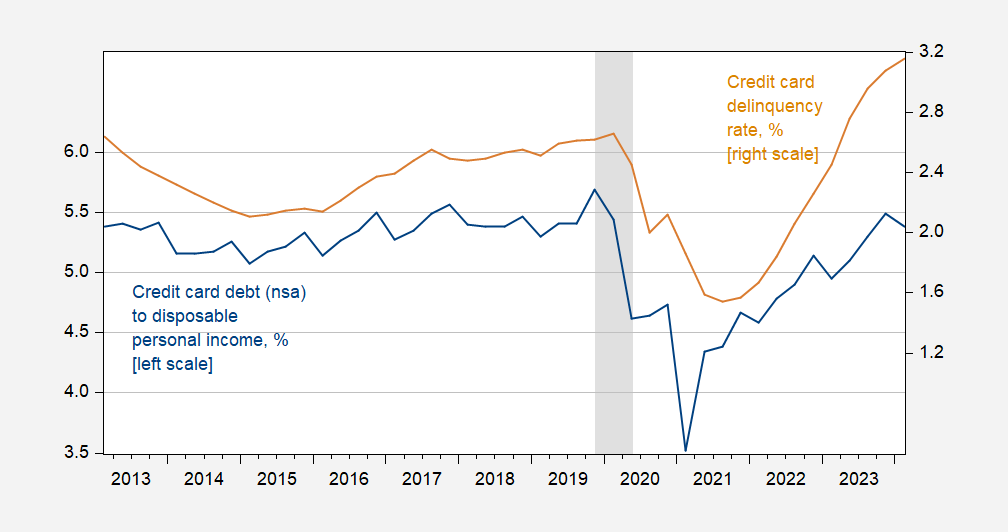

In addition to the standard complaints that this quantity was not normalized by disposable private revenue, or GDP, this struck me as a humorous indicator to glom onto. Right here’s normalized bank card debt together with delinquency fee.

Determine 1: Bank card debt (n.s.a.) to disposable private revenue, % (blue, left scale), and bank card delinquency fee for all business banks, % (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: NY Fed; Federal Reserve Board and BEA by way of FRED, NBER, and creator’s calculations.

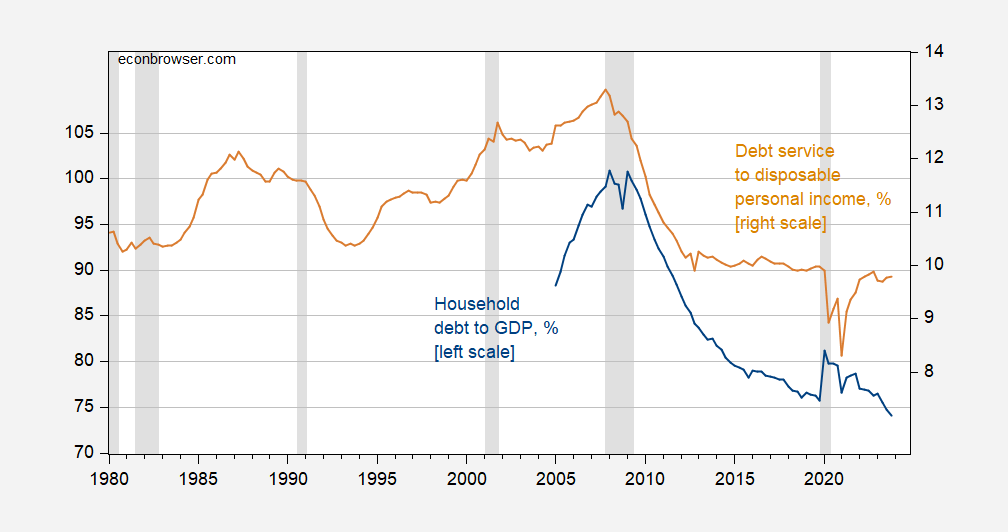

So bank card debt normalized goes down in Q2, however delinquencies are rising. This implies that one thing is happening, for some segments of the inhabitants, even whereas family debt-to-GDP and family debt service to disposable revenue ratios are falling.

Determine 2: Family debt to GDP, % (blue, left scale), and debt service to disposable revenue fee, % (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: IMF by way of FRED, Federal Reserve Board by way of FRED, NBER.

Debt service is likely to be fixed whilst rates of interest rise because of the pervasiveness of fastened fee mortgages. So, credit score woes are doubtless extra urgent for some revenue segments than others.