I’ve solely now gotten round to writing about this Trump coverage proposal: “Trump trade advisers plot dollar devaluation” . I used to be befuddled by how they Trump mind belief was going to successfully pressure the weakening of the greenback: sterilized intervention, dropping rates of interest within the US, or forcing international nations to re-peg their currencies at stronger values. All of them appear to be problematic.

Sterilized intervention: There’s not a lot proof that for nations with open capital markets this works, on an prolonged foundation (see Popper, 2022 for a survey).

Dropping US rates of interest: Effectively, if the US may drop rates of interest whereas forcing different nations to lift their very own, this might (within the absence of no matter turmoil in monetary markets this would possibly trigger) depreciate the greenback. If as well as, by dropping US rates of interest one may persuade monetary market contributors that inflation would speed up, then most traditional financial fashions of the trade charge would predict greenback depreciation within the quick run.

My estimates for an advert hoc mannequin 2005-2023 yields:

r = -5.61 + 2(y-y*) + 9.6i – 9.7i* – 0.81π + 1.51π* + 0.003VIX

Adj-R2 = 0.88, SER = 0.031, DW = 0.60, N =76. Coefficients in Daring point out significance on the 10% msl utilizing HAC strong normal errors.

The place r is log actual commerce weighted greenback, y is GDP, i is the ten yr yield, π is y/y CPI inflation, and * denotes rest-of-advanced economies. The match is proven in Determine 1:

Determine 1: Actual commerce weighted worth of US greenback (daring black), in-sample prediction (teal). NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve through FRED, NBER, and writer’s calculations.

If this set of correlations holds up into the longer term, then a one share level discount within the 10 yr Treasury yield relative to international would cut back the true worth of the greenback practically 10 p.c. Is that this potential in observe? That is onerous to say; in any case, long run charges are correlated, and different superior economies long run charges are inclined to comove.

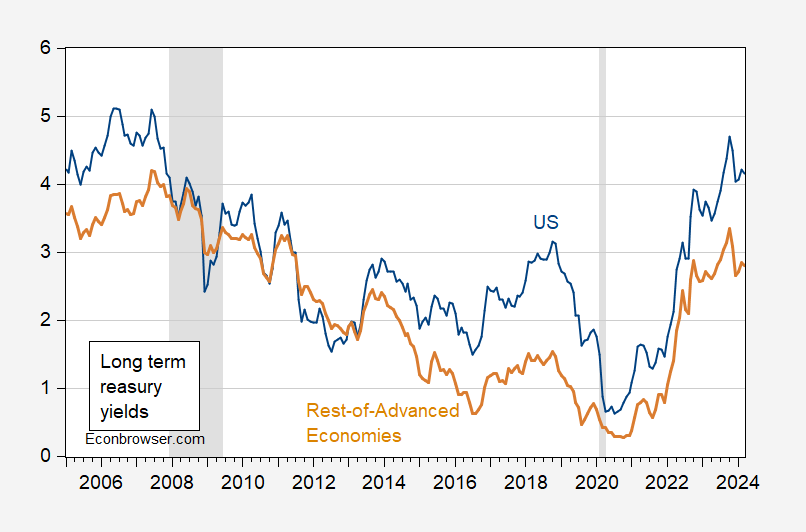

Determine 2: US Ten Yr Treasury yield (blue), rest-of-advanced financial system long run (5-10 years) authorities bond yields (tan), each in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, Dallas Fed DGEI, and NBER.

On this pattern interval, each share level change within the US Treasury yield is related to a couple of 0.6 share level change within the rest-of-advanced financial system yields.

After all, ought to charges be decreased within the US, then US GDP would doubtless develop sooner than in any other case, thereby barely offsetting the (already diminished) rate of interest impact. If the US has to exert some sturdy arm strategies to realize the “cooperation” of different nations, presumably the VIX would rise (because it usually did underneath Trump, significantly in the course of the commerce warfare). After all, the US Treasury can not in and of itself management the yield on Treasury bonds, in a market financial system. So the compliance of the Fed can be obligatory (which is perhaps why Trump’s mind belief is serious about make the Fed decision-making course of extra malleable).

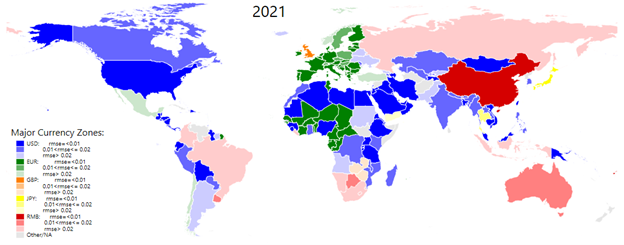

Forcing different nations to revalue: The nominal worth of the US greenback is a perform of insurance policies within the nations pegging to the greenback. Ito and Kawai determine forex zones as these pegging to respective currencies. As of 2021:

Determine 3: The Evolution of the Main Foreign money Zones. Supply: Compiled by authors from their estimations. Supply: Ito (2024).

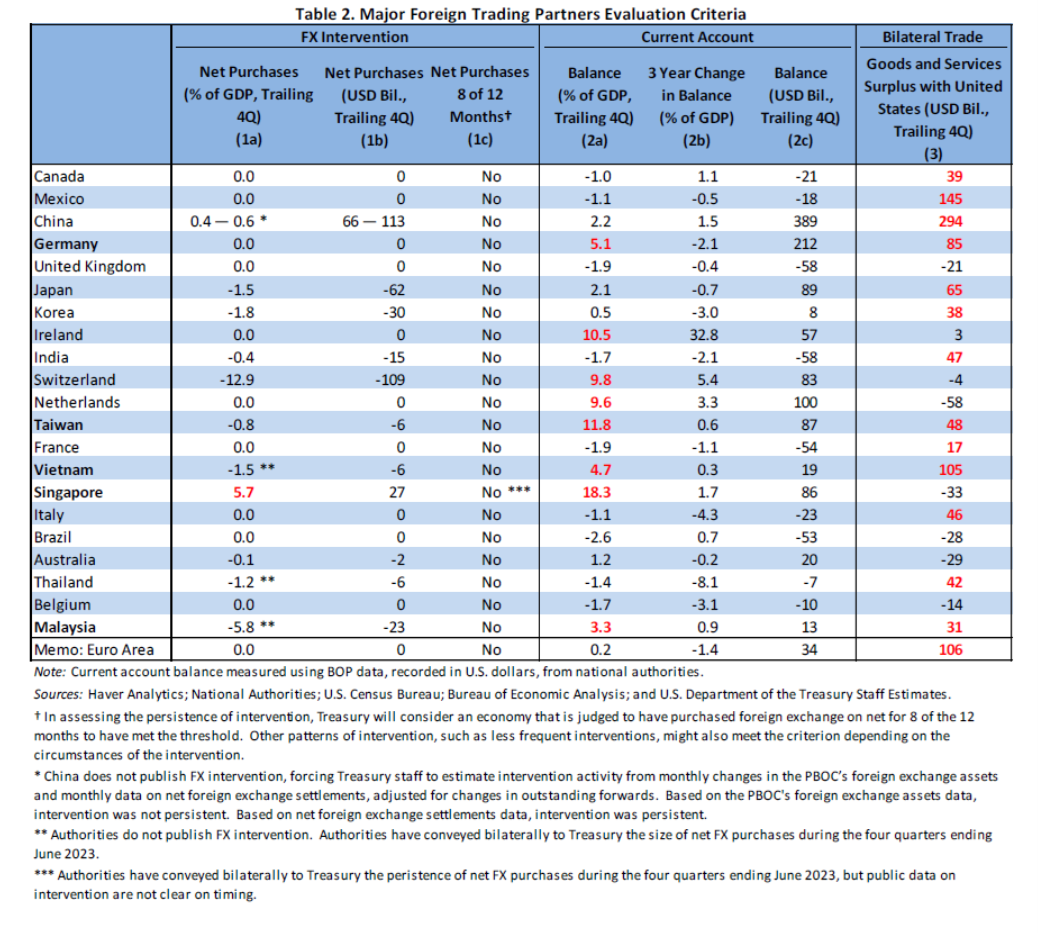

Of these nations recognized as being within the greenback zone, not all peg, or quasi-peg, to the greenback. However people who do, the US may cajole into revaluing. How huge of an impact? Adler, Lisack and Mano (Rising Markets Overview, 2022) discover that every one share level of GDP discount in FX intervention appreciates a bilateral actual trade charge by between 1.4-1.7 ppts. There may be some query whether or not China has returned to a greenback peg as of 2024, however we are able to study how possible it’s to get a giant appreciation of the US greenback by analyzing how a lot intervention is occurring now. The final US Treasury FX report, in November 2023, presents some statistics.

Supply: US Treasury (November 2023).

Singapore is intervening considerably (as a share of GDP), however has solely a 1.9% weight within the commerce weighted greenback (broad US Fed). China has a much bigger weight, 13.4% [1]. If China had been to scale back intervention by 1 ppt of GDP (the place it was estimated at 0.4-0.6 ppts by Treasury), then the RMB would respect by 1.4-1.7%. The direct impression on the commerce weighted greenback would then be 0.23 ppts to 0.28 ppts(!). To the extent that some nations peg their forex to the yuan, then one would possibly get a barely greater impact. Nevertheless, ultimately, it looks as if lots of work to get a small change within the worth of the greenback.

Extra analysis of the desirability of this coverage initiative, by Rampell (WaPo), in addition to Horan (Nationwide Overview).