The Harris Walz plan for reining in grocery costs seems to comprise two elements, certainly one of which has attracted a variety of consideration (stopping value gouging), whereas the second (antitrust in opposition to meals processors) has garnered much less criticism (see agenda right here). Whereas it is likely to be the case that grocery retailer chains are exploiting some monopoly energy, it’s not clear to me it’s crucial side of grocery value developments.

Right here’s an image of food-at-home retail costs vs. wholesale manufacturing meals costs (in addition to processed meat costs), all normalized in logs to 2021M01=0.

Determine 1: CPI meals at residence part (daring black), PPI meals manufacturing (gentle blue), and PPI processed meats, poultry and fish (purple), all in logs, 2021M01=0. NBER peak-to-trough recession dates shaded grey.

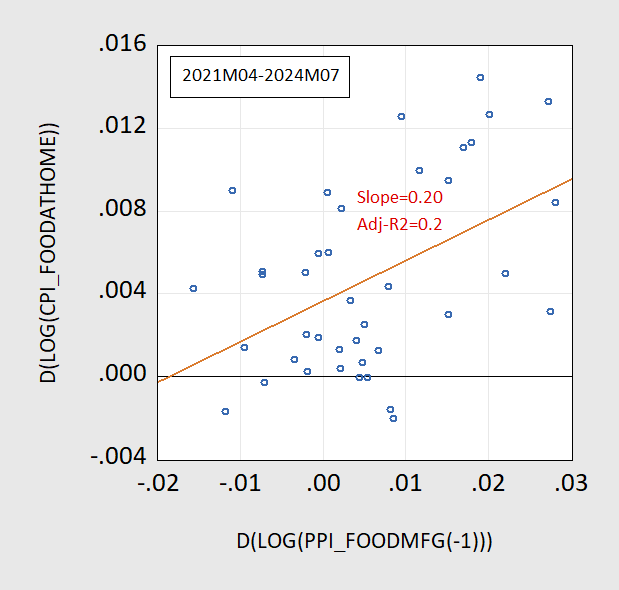

Be aware that processed meat costs jumped throughout the pandemic, partly due to the leap in wages (due partially to the pandemic induced constraints in labor provide). See how wages in meals processing jumped as international born labor provide fell, right here. Did the upper manufactured meals costs “cause” the upper grocery costs? That’s a sophisticated query to reply. What one can say is that from the interval a yr after the NBER-defined trough, to 2024M07, a Granger causality take a look at rejects the null speculation that adjustments in manufactured meals costs don’t have an effect on adjustments within the food-at-home part of the CPI on the 1% msl. The reverse fails to reject, on the 5% msl. Right here’s a scatterplot of log first variations of CPI-food at residence on lagged PPI-food mfg:

Determine 2: First log variations of CPI-food at residence vs lagged PPI meals mfg, and regression line.

Now, is the more and more concentrated nature of the meals processing at fault? As MacDonald, Dong and Fuglie, (2023) level out, it’s not clear, not less than within the pre-pandemic interval.

From the paper (p.36):

Meat and poultry processing industries have been remodeled as packers constructed giant vegetation to realize economies of scale. Processors additionally fashioned tighter linkages with a reorganized livestock manufacturing sector to guarantee a reliable provide of livestock to maintain vegetation at near-full capability. These transformations led to putting will increase in focus, notably in slow-growing pork and beef industries, whereas additionally resulting in decrease prices in livestock manufacturing and slaughter. Nonetheless, whereas there have been some vital mergers amongst processors, a lot of the expansion in focus happened from the development of recent, or the enlargement of, current vegetation by the massive processors, somewhat than from mergers amongst rivals. Regardless of excessive ranges of focus, research of cattle market pricing previous to 2010 discovered restricted proof of packer market energy. Decrease processing prices seemed to be largely handed to shoppers, and the ensuing elevated demand for beef in flip led to increased cattle demand and costs. There have been fewer research of poultry or pork markets, however these research discovered solely small or native results from focus on costs in these industries. Nonetheless, developments since 2010, which present rising spreads between processor costs paid for livestock and acquired for meat, in addition to new entrants to the business, counsel that meatpackers now have been in a position to train higher market energy over livestock costs than in earlier a long time. New entry, and plant enlargement amongst incumbent producers, will decide whether or not such market energy might be maintained.

The offsetting results from exploiting higher economies of scale vs. higher value energy might result in small will increase and even internet decreases in output costs. Nonetheless, the imposition of tightly binding constraints from restricted labor provide might change that steadiness.

Anti-trust actions are a lot much less prone to have distortionary results on meals markets than outright value controls. In any case, it’s unclear to me that outright value controls are what the Harris-Walz marketing campaign has in thoughts.