By no means simply look the headline quantity. The “why’s” matter. GDPNow down from 3.3% q/q AR to 2.8%, whereas GS monitoring at 3.0%

.

Supply: Rindels, Walker, “US Daily: Q3 GDP Preview,” Goldman Sachs World Investor Analysis, October 29, 2024, Exhibit 2.

2.8% or 3% is lower than earlier nowcasts, however nonetheless manner above recession ranges (suppose EJ Antoni, who thought the recession would possibly’ve began in July or August).

If one seems on the GDPNow forecast evolution (as of 29 October 2024), one sees {that a} massive cause for the decline in nowcast is greater imports. How does one interpret this?

Interpretation highlights the distinction between accounting and economics. The next development charge of imports (not attributable to trade charge appreciation) presumably means sooner development is predicted now and sooner or later (extra imports for consumption and funding the place each are ahead trying variables). Nonetheless, a push up within the nowcasted stage of imports holding fixed nowcasts of the opposite parts of GDP (GDP ≡ C+I+G+X-IM) implies that the nowcast of GDP is lowered (h/t my outdated colleague at CEA Steve Braun for instructing me this).

Right here, imports stunned on the upside. From the advance financial indicators launch in the present day:

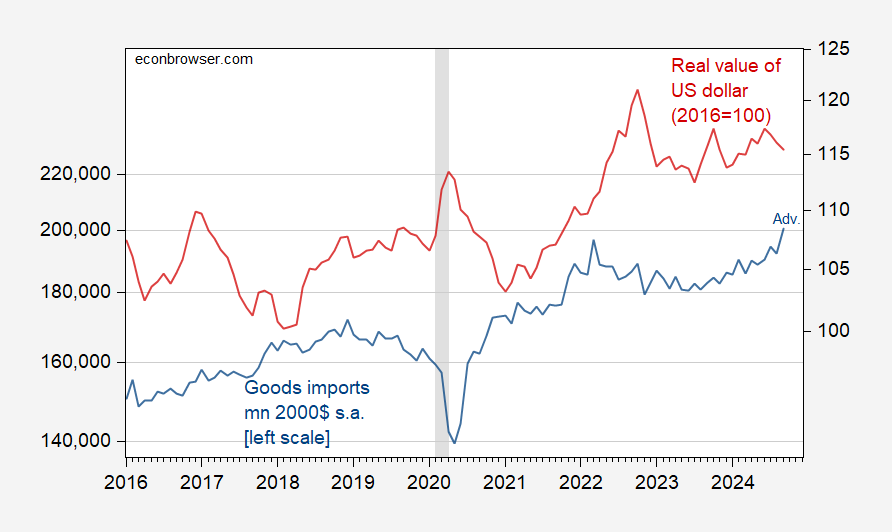

Determine 1: Actual items imports, in mn. 2020$ (blue, left log scale), and actual worth of the US greenback (crimson, proper log scale). Deflation of imports utilizing BLS worth of imports of commodities. NBER outlined peak-to-trough recession dates shaded grey. Supply: Census and Federal Reserve by way of FRED, NBER, and writer’s calculations.

So, this quarter’s numbers are down, whereas the implied development charge (ceteris paribus) is up for subsequent quarter.