We’ve loads of competing assessments as of at the moment. From three Federal Reserve Banks and Goldman Sachs.

Determine 1: GDP (daring black), Survey of Skilled Forecasters August median forecast (tan), GDPNow (blue sq.), NY Fed (purple triangle), St. Louis Fed (gentle inexperienced inverted triangle), Goldman Sachs (teal circle), all in bn.Ch.2017$. Nowcasts are as of 9/6 besides the place famous; nowcast ranges calculated iterating progress price to reported 2017Q2 2nd launch GDP ranges. Supply: BEA 2024Q2 2nd launch, Philadelphia Fed for SPF, Atlanta Fed (9/4), NY Fed (9/6), St. Louis Fed (9/6), Goldman Sachs (9/6), and writer’s calculations.

As well as, S&P World Month-to-month Insights (previously Macroeconomic Advisers) experiences 2.0% progress as of 9/3, barely under the two.1% from GDPNow

The upwards revision in Q2 GDP plus subsequent info has pushed nowcasts uniformly above the SPF median forecast (reported by early August). It’s laborious to see how quick horizon assessments of recession likelihoods have elevated. For comparability, listed here are the early August forecasts likelihoods from SPF:

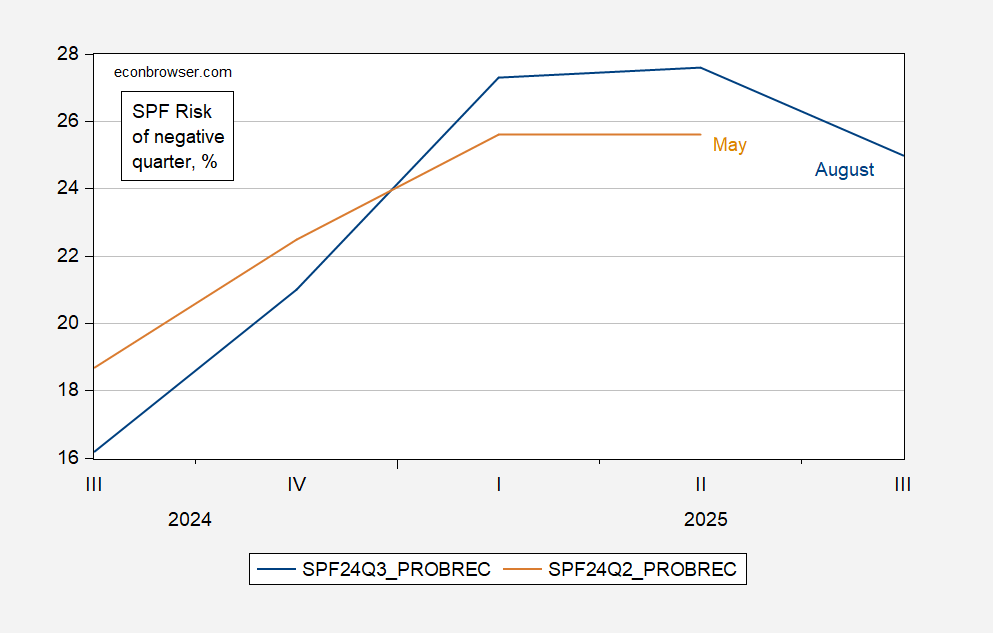

Determine 2: Danger of adverse quarter progress, from August survey (blue), from Might survey (tan), each in %. Supply: Philadelphia Fed.

Recession possibilities down in close to quarters (Q3, This fall), up in far (2025Q1, Q2).