From the Nationwide Corn Growers Affiliation:

U.S. soybeans and corn are prime targets for tariffs. As the highest two export commodities for our nation, collectively they account for about one-fourth of complete U.S. agricultural export worth. As such, a repeated tariff-based strategy to addressing commerce with China locations a goal on each U.S. soybeans and corn. Farmers and rural economies pay the value because of this.

The report’s most important conclusion (learn the entire research for assumptions, mannequin, and so on.):

Research Findings

U.S. Soybean & Corn Exports Drop Whereas Brazil Features Market Share

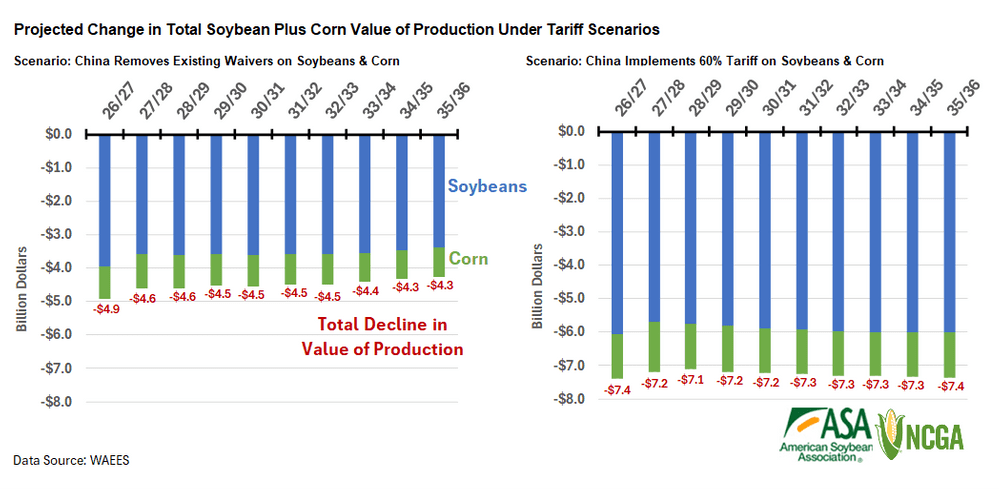

If China cancels its waiver and reverts to tariffs already on the books, U.S. soybean exports to China fall between 14 and 16 million metric tons yearly, a median decline of 51.8% from baseline ranges anticipated for these years. U.S. corn exports to China fall about 2.2 million metric tons yearly, a median decline of 84.3% from the baseline expectation. Though the export amount decline is way decrease for corn than soybeans, reflecting the smaller amount of corn exported to China, the relative change from the baseline amount is important for corn.

Whereas it’s doable to divert exports to different nations, there’s not sufficient demand from the remainder of the world to offset the foremost lack of soybean exports to China. On the similar time, Brazil and Argentina acquire world market share with elevated exports. The U.S. loses a mixed complete of two.3 to three.7 million metric tons of soybean plus corn exports yearly, whereas Brazil positive factors a median of 4.6 million metric tons of soybean plus corn exports yearly.

Chinese language tariffs on soybeans and corn from the U.S. however not Brazil present incentive for Brazilian farmers to develop manufacturing space much more quickly than baseline progress. The growth is magnified as a result of some land space in Brazil can be utilized to develop a soybean and corn crop in the identical yr. Land transitioned into manufacturing space in Brazil will stay in manufacturing. The impression on U.S. soybean and corn farmers isn’t restricted to a short-term worth shock: It is a long-lasting ramification that modifications the worldwide provide construction.

A 60% retaliatory tariff stage intensifies the shock, leading to a lack of over 25 million metric tons of soybean exports to China and almost 90% of corn exports to China. On this scenario, the U.S. loses a mixed complete of two.9 to 4.6 million metric tons of soybean plus corn exports yearly, whereas Brazil positive factors a median of 8.9 million metric tons of annual soybean plus corn exports over the projection timeline.

Right here’s their evaluation of the impression on US manufacturing in each situations.

In sum, farmers will see money earnings decline whereas prices improve.

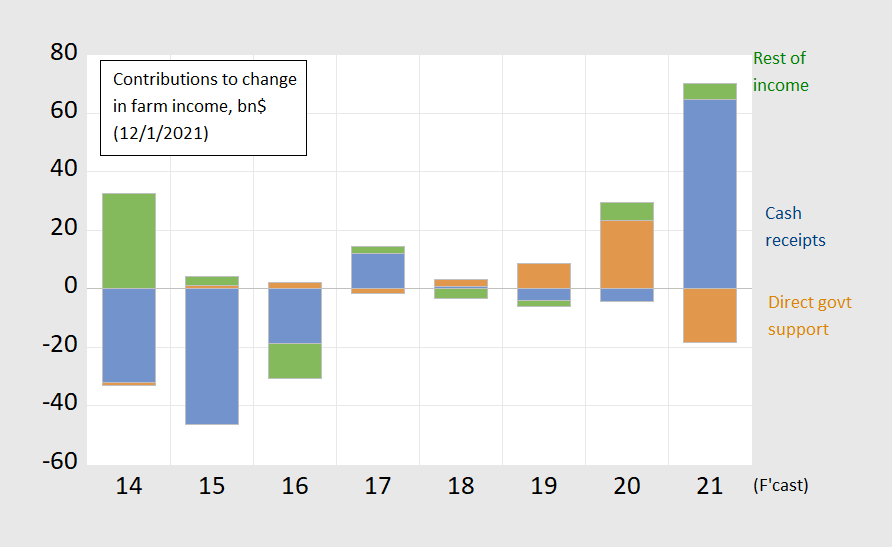

From a January 2022 put up, one can see how large a switch the Trump administration needed to implement to be able to prop up farm earnings within the wake of that commerce struggle, and the way money earnings popped up in 2021. Therefore, regardless of decrease authorities assist, internet earnings is forecasted to be up.

Determine 1: Contributions to alter in farm earnings from money receipts from gross sales (blue bar), from direct authorities assist (brown bar), and from all different parts (inexperienced bar). Supply: USDA, information of 12/1/2021.

This time round, if Trump have been to impose 10-20% tariffs on every thing imported and 60% tariffs on Chinese language imports, then there’ll be much more folks in line for bailouts than final time. In case you consider the farmers can be first in line subsequent spherical, then there’s a bridge I wish to promote you.

See extra on the impression on the Midwest right here.

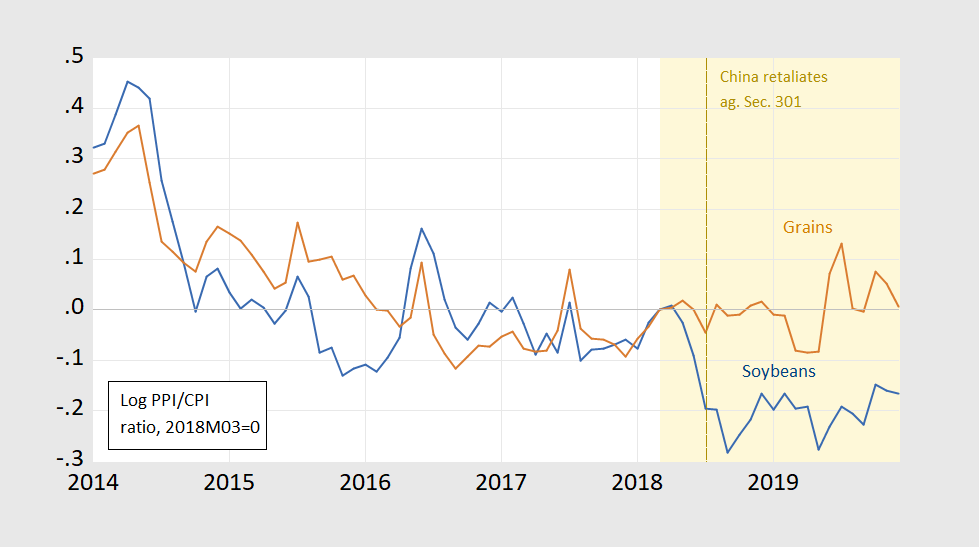

For a nostalgic journey down event-study lane, see this January 2020 put up, with this graph:

Determine 2: CPI deflated PPI for soybeans (blue) and grains (brown), in logs 2018M03=0. Orange shading denotes interval throughout which China Part 301 motion is introduced/applied. Brown dashed line is when Chinese language tariffs on US soybeans goes into impact. Supply: BLS through FRED, writer’s calculations.