From X, on Thursday:

That is past ridiculous: industrial manufacturing and capability utilization noticed one other huge downward revision, and Jul’s print nonetheless got here in damaging M/M – manufacturing is in recession:

Notice: Dr. Antoni has used industrial manufacturing, capability utilization within the above graph, relatively than manufacturing.

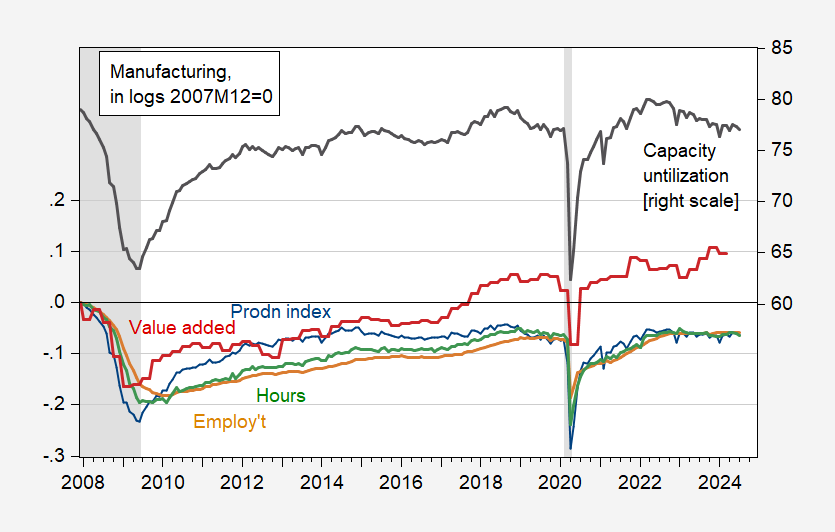

This struck me as an odd characterization, so I plotted the information over the identical interval (utilizing manufacturing as a substitute of commercial classification).

Determine 1: Manufacturing manufacturing (blue, left scale), employment (tan, left scale), combination hours (inexperienced, left scale), and actual valued added (purple), all in logs, 2007M12=0, and capability utilization in manufacturing, in % (black, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Notice: 2007M12 is NBER’s enterprise cycle peak. Supply: Federal Reserve, BLS, BEA by way of FRED, NBER.

The determine highlights two factors: (1) manufacturing manufacturing (Fed index) and worth added differ, for the reason that former is gross, the latter web; (2) employment and hours are problematic measures for indicators since productiveness in manufacturing is greater than the general economic system.

Whereas capability utilization has declined, it’s nonetheless greater than the extent on the eve of the pandemic.

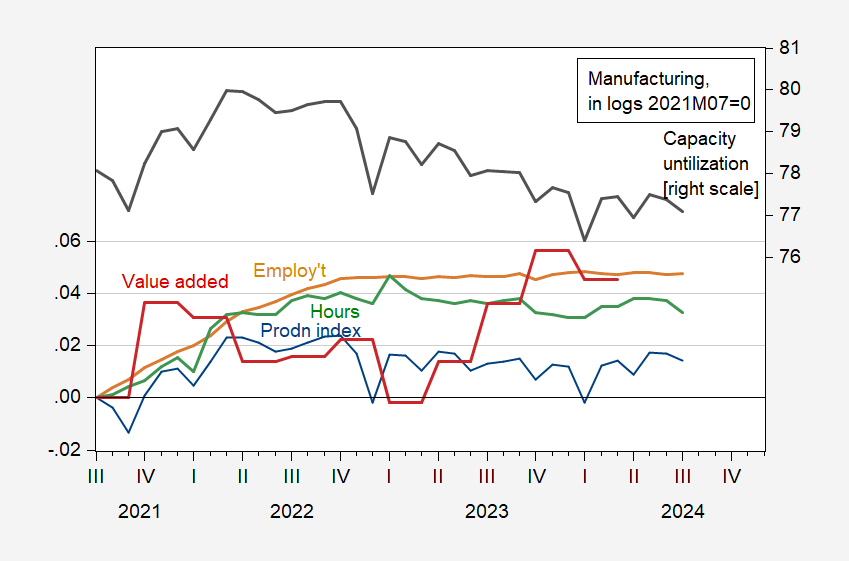

It’s onerous to see what’s happening extra lately, so I current the corresponding post-pandemic information in Determine 2:

Determine 2: Manufacturing manufacturing (blue, left scale), employment (tan, left scale), combination hours (inexperienced, left scale), and actual valued added (purple), all in logs, 2021M07=0, and capability utilization in manufacturing, in % (black, proper scale). Supply: Federal Reserve, BLS, BEA by way of FRED.

We don’t have worth added for Q2, however we do have manufacturing manufacturing and employment by means of July. These preliminary figures point out slowing, however not clear to me they’re into recession territory (no matter a sectoral recession is).