One of many attention-grabbing facets of the annual revision is that, opposite to what occurs with typical (non-annual) revisions, GDI moved towards GDP, relatively than the reverse.

Determine 1: GDP post-update (daring blue), GDP pre-update (blue), GDI post-update (daring pink), GDI pre-update (pink), all in bn.Ch.2017$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, 2024Q2 third launch/annual replace, BEA 2024Q2 2nd launch, NBER, and writer’s calculations.

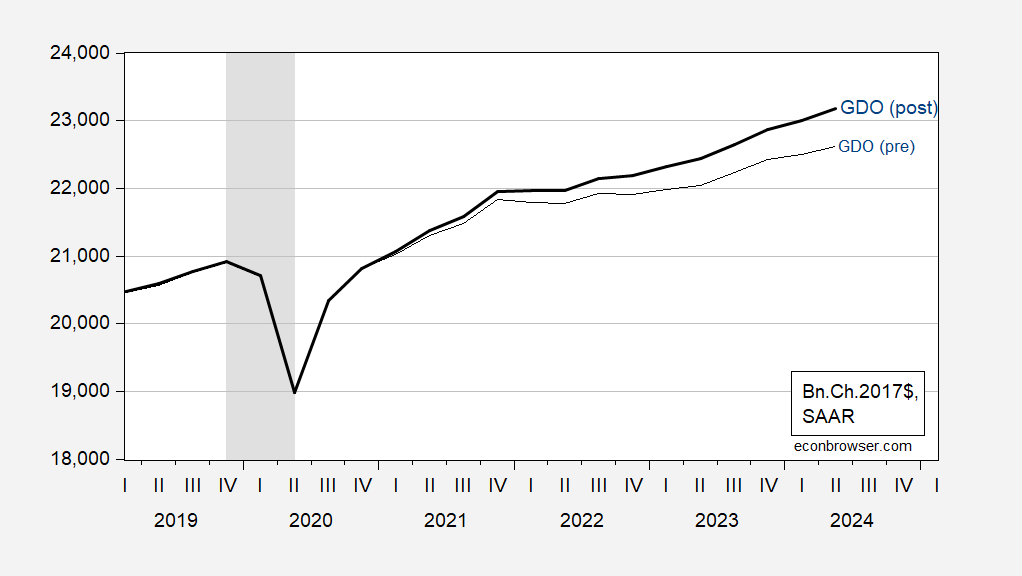

Determine 2: GDO post-update (daring blue), GDO pre-update (blue), all in bn.Ch.2017$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, 2024Q2 third launch/annual replace, BEA 2024Q2 2nd launch, NBER, and writer’s calculations.

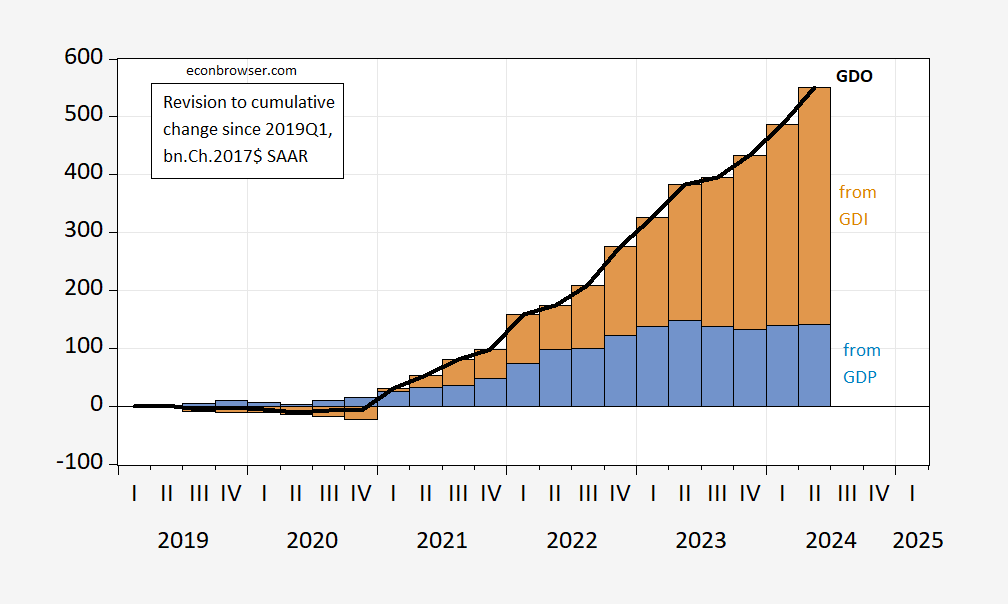

GDP was revised up, however GDO was revised up much more. That is proven in Ch2017$ phrases in Determine 3 (the place the annual revisions apply to 2019-2023).

Determine 2: Relative to 2019Q1, change in GDO post-vs-pre replace (daring black line), change attributable to GDP (blue bars), change attributable to GDI (tan bars), all in bn.Ch.2017$ SAAR. Supply: BEA, 2024Q2 third launch/annual replace, BEA 2024Q2 2nd launch, NBER, and writer’s calculations.

The lion’s share of the change in GDO vs pre-update is attributable to modifications in GDI. This matches up with claims that BEA had been undercounting/estimating non-labor earnings.