The summary from article forthcoming within the Journal of Worldwide Cash and Finance.

We start by inspecting determinants of combination overseas trade reserve holdings by central banks (measurement of issuing nation’s economic system and monetary markets, skill of the foreign money to carry worth, and inertia). However understanding the willpower of reserve holdings in all probability requires going past the mixture numbers, as an alternative observing particular person central financial institution conduct, together with traits of the holding nation (bilateral commerce with the issuing nation, bilateral foreign money peg, and proxies for bilateral publicity to sanctions), along with the traits of the reserve foreign money issuer. On a currency-by-currency foundation, US greenback holdings are considerably effectively defined by a number of issuer traits; however the different currencies are much less efficiently defined. It might be that the outcomes from currency-by-currency estimation are impaired by inadequate pattern measurement. This consideration affords a motivation for pooling the info throughout the key currencies and imposing the constraints that reserve holdings are decided in the identical means for every foreign money. On this setting, most financial determinants enter with significance: financial measurement as measured by GDP, bilateral foreign money peg, and bilateral commerce share. Whereas one geopolitical issue (congruence in voting within the UN) is often vital within the anticipated method (excluding the US greenback), the opposite geopolitical issue (sanctions) doesn’t enter with significance.

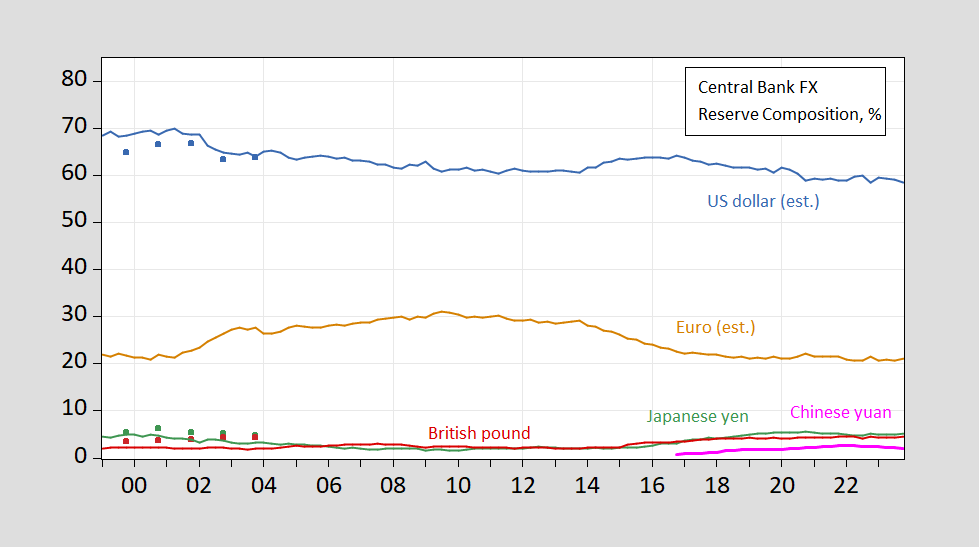

Right here’s an image of the mixture foreign money shares, from the IMF’s COFER database, up to date knowledge launched on June eleventh.

Determine 1: Share of overseas trade reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (purple). For 1999 knowledge onward, estimates primarily based on COFER knowledge, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 6/20/2024, and writer’s estimates.

And right here’s a element, for 1999 onward:

Determine 2: Share of overseas trade reserves held by central banks, in USD (blue), EUR (orange), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (purple). For 1999 knowledge onward, estimates primarily based on COFER knowledge, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 6/20/2024, and writer’s estimates.

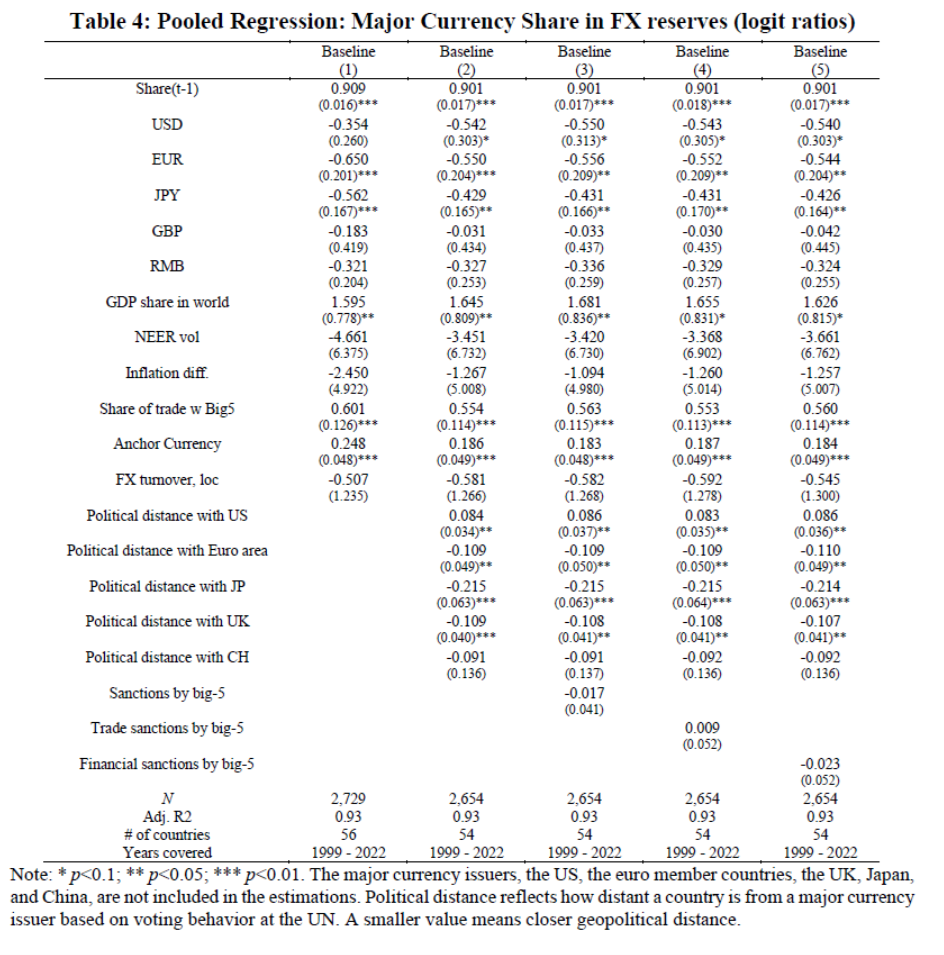

Equations used to estimate combination shares pre-EMU are fairly ineffective in predicting shares now. Therefore, on this new paper, we depend on particular person central financial institution knowledge to estimate the determinants of shares. The outcomes of a pooled cross-country cross-currency, unconstraining the geopolitical distance coefficient to range throughout foreign money, are reported in Desk 4.

Supply: Chinn, Frankel, Ito (forthcoming, JIMF).

Following the ends in Chinn and Frankel (2007), we discover financial measurement issues, in addition to inertia. Whereas we discover retailer of worth measures (inflation, trade fee volatility) have a destructive impression, these results should not statistically vital. This particular knowledge set (central financial institution by 12 months) permits us to analyze the impression of commerce flows and peg, which seems to be necessary. We replicate the discovering obtained by Goldberg and Hannaoui (2024) that extra geopolitically distant nations (as measured by coincidence in UN GA voting) maintain higher greenback shares, whereas the reverse is true for the opposite currencies. Whereas monetary sanctions have a destructive impression, the measured sensitivity just isn’t statistically vital.

Whereas we don’t explicitly file how greenback shares have declined, it’s helpful to notice that different research (see Arslanalp, Eichengreen and Simpson-Bell (2024), and references therein) have documented that the slack just isn’t basically being largely take up by the RMB, however different unconventional currencies.

See additionally Eswar Prasad’s current Overseas Affairs piece, the Third annual Fed-FRBNY convention on the worldwide roles of the greenback, Kamin and Sobel (2024), Atlantic Council “Dollar Dominance Monitor”.