PBoC and monetary regulators act, however even with fiscal measures underway, are unlikely to drastically change the trail of the economic system.

As summarized by Bloomberg:

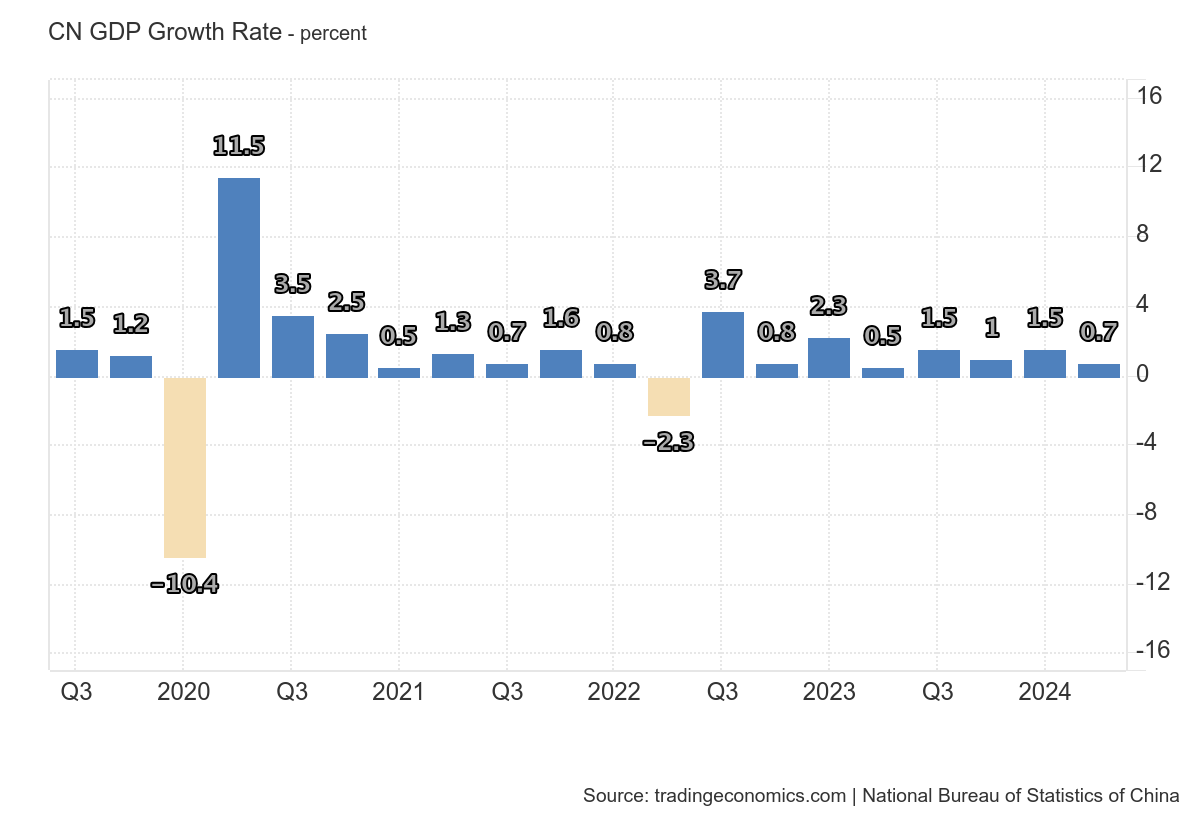

To me, it’s curious it took so lengthy, then adopted by a flurry of exercise within the final 48 hours previous the announcement. I’ve no specific insights into the workings of policymakers beneath the present regime, so I’ll let others debate the sources of delayed motion. Nevertheless, listed below are some macro indicators that present the necessity for some motion — decelerating progress, and deflation. First GDP progress (q/q SA):

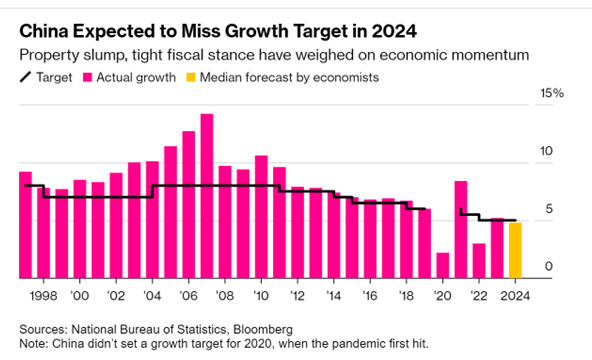

Taken at face worth, 0.7% q/q is 2.8% annualized(!). There have been doubts that beneath earlier set of macro and regulatory insurance policies, the 5% goal (y/y I feel) could be hit.

Supply: Bloomberg, 24 Sep 2024.

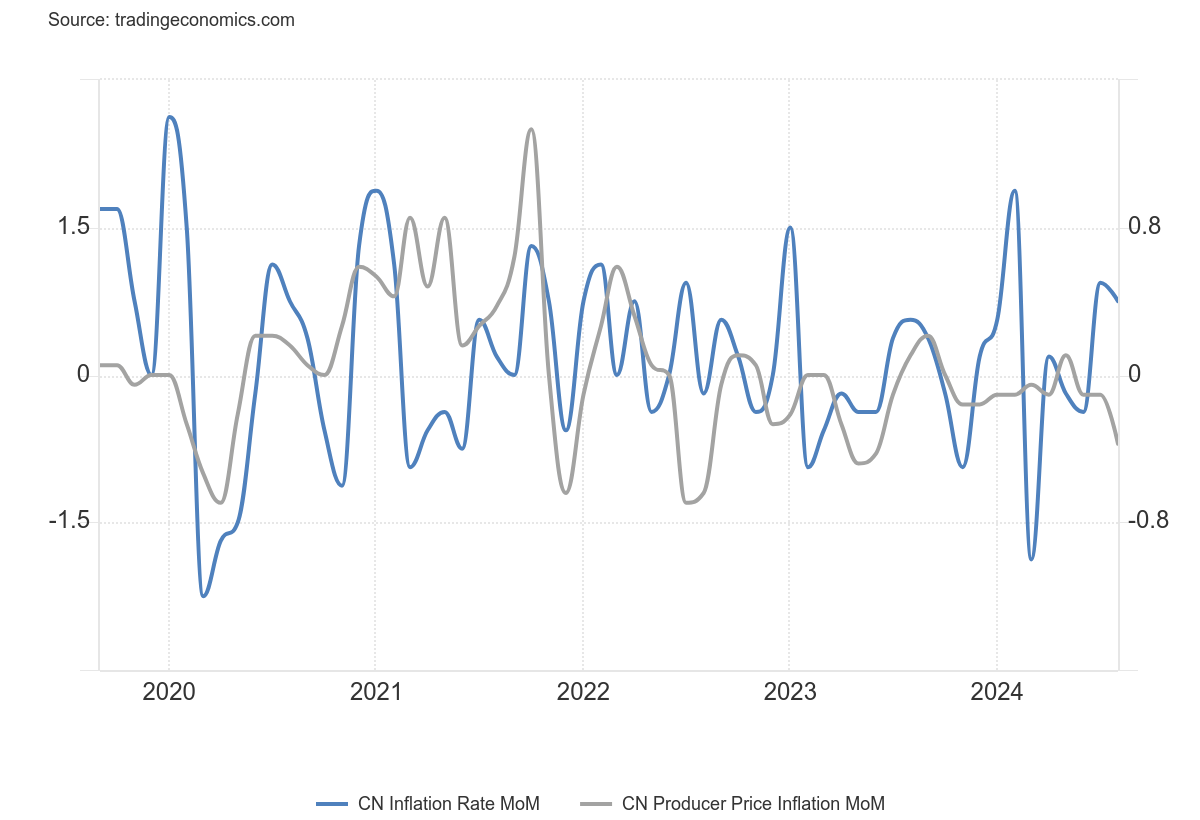

Second, deflation. Extra worrying in some methods is the decline in costs — not within the CPI however on the producer degree, and for the economic system total. CPI and PPI m/m inflation charges (observe distinction of scales, left vs. proper axes). Deflation is usually a sign of slowing progress, in addition to exacerbating demand shortfalls.

So whereas shopper costs have risen in latest months, producer costs have fallen. As famous within the Bloomberg article, the GDP deflator has additionally fallen, for 5 straight quarters (-3.8% 4 quarter change as of Q2).

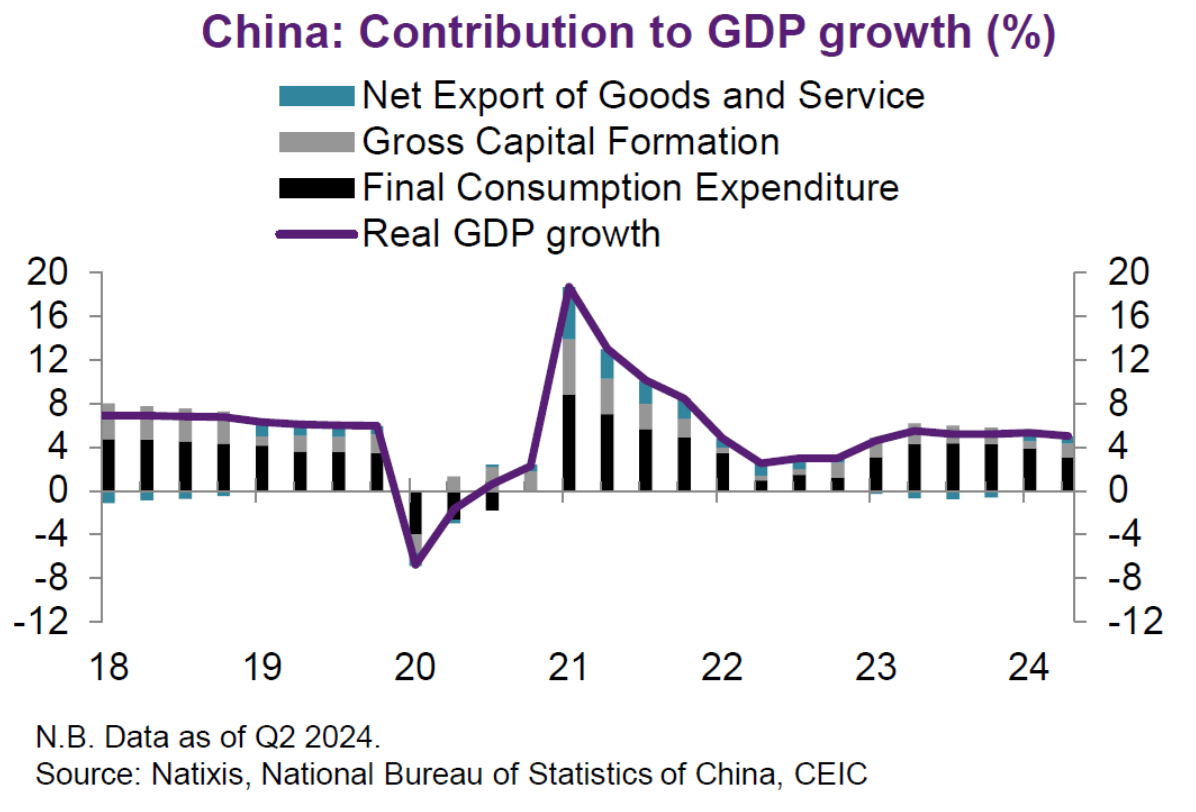

The quandary is proven within the decomposition of GDP:

Supply: Garcia Herrero & Xu, Natixis, 13 Sep 2024.

Even supposing the above is a mechanical decomposition (an accounting identification), one can nonetheless make some inferences concerning the constraints to progress. Consumption is the primary contributor to progress – however customers are reluctant to spend within the wake of the collapse of the housing sector. Deflation makes debt extra burdensome (consider the monetary accelerator). Internet exports may contribute extra to GDP, however with the surge in Chinese language exports already eliciting commerce boundaries not solely within the US, but additionally in Europe, it’s exhausting to think about a giant increment coming from extra internet exports.

What’s going to sort things? It relies upon what “fix” means. Return to +5% progress? Or simply continued progress with out collapse. I feel the consensus view is +5% progress is off the desk. So avoiding a full-blown disaster, with hopefully optimistic progress charges is the aim.

Eswar Prasad notes the necessity to speed up productiveness progress (which impacts the long term, however — relying on how applied — additionally the quick run by way of expectations):

Recognizing the necessity to enhance productiveness and shift away from low-skill manufacturing, the federal government just lately articulated a “dual circulation” progress coverage, which augments continued engagement with international commerce and finance with better reliance on home demand, technological self-sufficiency, and homegrown innovation. However the strategy has run into difficulties. China nonetheless wants overseas expertise to improve its business, and rising financial and geopolitical rifts with the USA and the West may restrict China’s entry to overseas expertise and hi-tech merchandise, in addition to to markets for its exports. Furthermore, the federal government’s latest crackdown on personal corporations in sectors resembling expertise, schooling, and well being has had a chilling impact on entrepreneurship.

The continued decline in inward FDI suggests there’s been no reversal within the circumstances for FDI into China – unsurprising given the Xi administration has probably not modified the general financial framework, together with “dual circulation”. (In fact, FDI into China might need additionally occurred due to makes an attempt to friendshore, in addition to the prospect of restrictions of governmental restrictions on outbound FDI).

So, don’t search for a fast repair. And anticipate even much less, if the Xi administration continues to put main weight on political dominance versus GDP progress (see e.g. Arthur Kroeber ).