I’m taking the WSJ’s phrase for it, from the article “Russia’s War Economy Shows New Cracks After the Ruble Plunges”.

The Russian financial system, surprisingly resilient via two-plus years of conflict and sanctions, has immediately begun to indicate critical strains.

The ruble is plunging. Inflation is hovering, and President Vladimir Putin informed the Russian individuals this week that there isn’t any motive to panic.

The catalyst for the change in financial fortunes was a call by the Biden administration to ratchet up sanctions on Russia’s Gazprombank, the final main unsanctioned financial institution that Moscow makes use of to pay troopers and course of commerce transactions, in addition to greater than 50 different monetary establishments.

Whereas official statistics have definitely depicted a surprisingly resilient Russian financial system, there are undoubtedly questions relating to it’s true energy (remembering that “Potemkin village” is a time period originating from that nation). First the plunge within the ruble signifies the tradeoff that’s being made between defending the foreign money, staunching inflation and retaining the financial system rising.

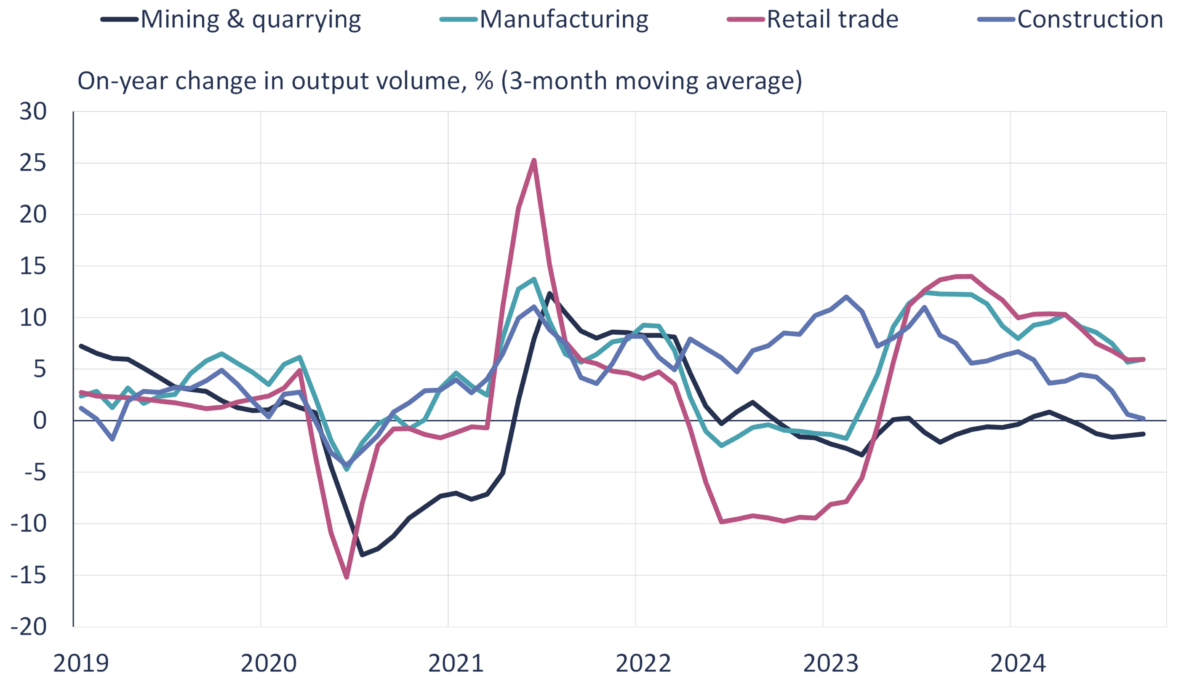

Bofit, per week in the past, highlighted the deceleration in y/y development:

Russian GDP development slowed considerably within the third quarter

Rosstat’s preliminary estimate places Russian GDP development in July-September at 3.1 % y-o-y. GDP development has slowed considerably this autumn. All core sectors have proven weaker development in current months in comparison with the primary half of this yr.

The slowdown in GDP development has largely been pushed by pressures from the mining & quarrying and building sectors. On-year output of mineral extraction industries (contains oil & gasoline) has fallen in current months, whereas on-year development in building is virtually zero. Agricultural output additionally contracted within the third quarter. GDP development has nonetheless been supported by manufacturing and retail gross sales, however development has slowed additionally in these branches. Manufacturing development, in flip, has been pushed primarily by industries associated to conflict.

Right here’s their graph, utilizing official statistics:

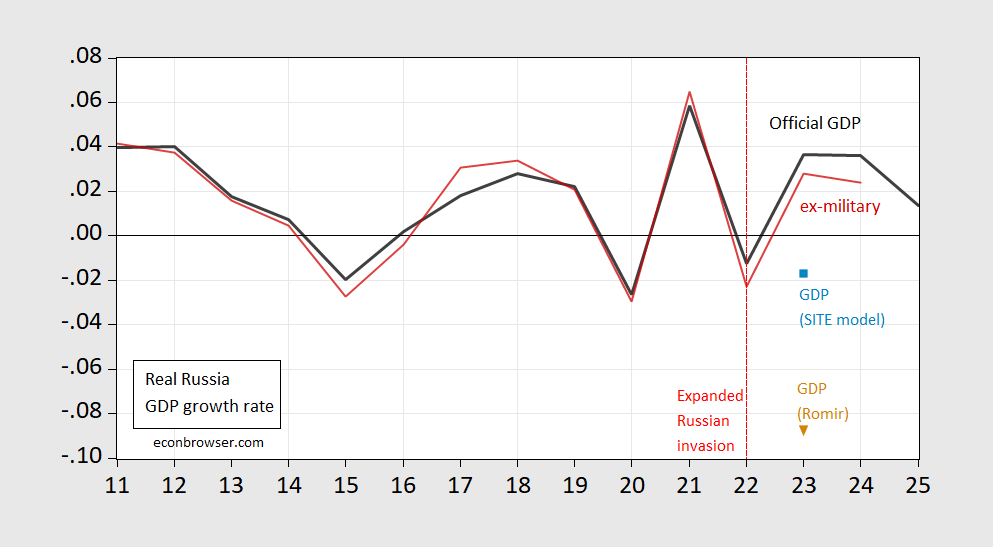

Lastly, let’s take into consideration the plausibility of Russian statistics, and likewise what GDP measures. First, examine official GDP to official GDP ex-military spending (as estimated by SIPRI):

Determine 1: Official Russian GDP development (black), official GDP ex-military spending development (purple), Russian GDP utilizing SITE oil-based mannequin (mild blue sq.), official GDP utilizing Romir value index as deflator (tan inverted triangle). GDP ex-military spending calculated utilizing nominal values, deflating by general GDP deflator. Supply: IMF October 2024 WEO, SIPRI database, SIPRI, SITE (Determine 26), and writer’s calculations.

The sturdy development seems much less sturdy when deducting outright navy expenditures (notice that capital prices related to protection spending, together with different inside safety operations, wouldn’t be included in SIPRI’s estimates of navy expenditures).

As well as, the Stockholm Institute of Transition Economies, in it’s current report on the Russian economy, supplies a number of different estimates of Russian GDP development. I present two estimates: (i) one based mostly on a easy econometric mannequin linking oil costs to Russian GDP, and (ii) nominal GDP deflated by the Romir value index (see this put up).