by Calculated Danger on 5/15/2024 09:02:00 AM

Listed here are just a few measures of inflation:

The primary graph is the one Fed Chair Powell had talked about when providers much less hire of shelter was up round 8% year-over-year. This declined, however has turned up lately, and is now up 4.9% YoY.

Click on on graph for bigger picture.

This graph exhibits the YoY value change for Companies and Companies much less hire of shelter by means of April2024.

Companies much less hire of shelter was up 4.9% YoY in April, up from 4.8% YoY in March.

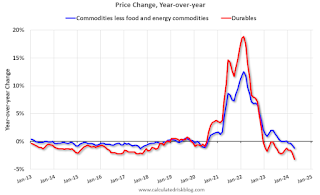

The second graph exhibits that items costs began to extend year-over-year (YoY) in 2020 and accelerated in 2021 because of each robust demand and provide chain disruptions.

The second graph exhibits that items costs began to extend year-over-year (YoY) in 2020 and accelerated in 2021 because of each robust demand and provide chain disruptions.

Commodities much less meals and vitality commodities had been at -1.2% YoY in April, down from -0.7% YoY in March.

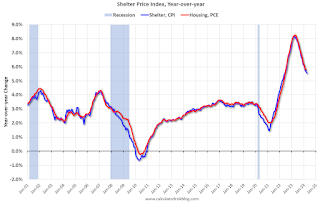

Here’s a graph of the year-over-year change in shelter from the CPI report (by means of April) and housing from the PCE report (by means of March)

Here’s a graph of the year-over-year change in shelter from the CPI report (by means of April) and housing from the PCE report (by means of March)

Shelter was up 5.5% year-over-year in April, down from 5.6% in March. Housing (PCE) was up 5.79% YoY in March, down barely from 5.85% in February.

That is nonetheless catching up with personal knowledge. The BLS famous this morning: “The index for shelter rose in April, as did the index for gasoline. Combined, these two indexes contributed over seventy percent of the monthly increase in the index for all items.“

Core CPI ex-shelter was up 2.1% YoY in April, down from 2.4% in March.