Daniel Lacalle through Zerohedge writes

Professors EJ Antony and Peter St Onge not too long ago revealed a wonderful research, “Recession Since 2022: US Economic Income and Output Have Fallen Overall for Four Years,” by means of the Brownstone Institute. It completely summarizes why Individuals haven’t responded favorably to Bidenomics and his evaluation of his financial legacy because the “best economy in the world” or “the best economy ever.” The research concludes that changes reflecting a extra lifelike measure of common value will increase within the interval have understated cumulative inflation by almost half since 2019. An unlimited divergence between reported CPI and adjusted inflation led to an overstatement of cumulative GDP development by roughly 15%. Moreover, these changes point out that the American financial system has been in recession since 2022.

I’ve documented why the Antoni-St. Onge evaluation is to not be given any credence [1] [2] [3] [4] (or as a lot credence as we gave ShadowStats, with which it shares a whole lot of DNA). I attempted to duplicate their value stage calculations (utilizing home costs and mortgage charges), and the closest I acquired was the inexperienced line beneath.

Determine 1: BEA GDP (orange), GDP incorporating PCE utilizing Case-Shiller Home Value Index – nationwide instances mortgage charge issue index, utilizing BEA weight of 15% (mild inexperienced), utilizing 30% weight (darkish inexperienced), Antoni-St. Onge estimate (pink sq.), all in bn.Ch.2017$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, S&P Dow Jones, Fannie Mae through FRED, NBER, and creator’s calculations.

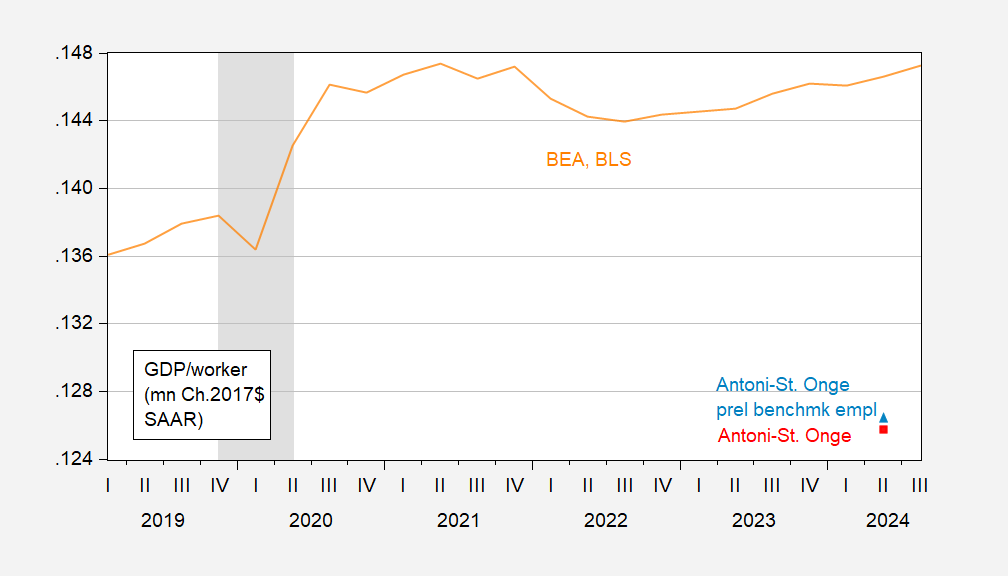

A technique to consider the plausibility of their estimates is to consider what their GDP calculation implies for productiveness. The pink sq. is their quantity, the GDP/employee quantity I get from BEA and BLS sequence is the orange.

Determine 2: Actual GDP divided by nonfarm payroll employment (orange line), and Antoni-St. Onge GDP divided by nonfarm payroll employment (pink sq.), Antoni-St. Onge GDP divided by benchmarked nonfarm payroll employment (mild blue triangle), all in mn.Ch.2017$ per employee. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, BLS, NBER, and creator’s calculations.

Dr. Antoni has made a lot of how the preliminary benchmark has drastically lowered the variety of employed (though Goldman Sachs has estimated the ultimate revision is not going to be downward as a lot because the preliminary). Utilizing the preliminary benchmark solely pushes up the extraordinarily low output per employee a slight quantity.