The Coalition for a Affluent America and the Blue Collar Greenback Institute have developed a measure of foreign money misalignment, reported of their newest Foreign money Misalignment Monitor (April challenge).

Supply: CPA.

Word that the US estimate is for a multilateral steadiness, whereas the person estimates are the implied greenback/native foreign money change for a given transfer to a person nation’s “equilibrium” change price.

There’s a purpose why I put the phrase “equilibrium” in quotes. The CPA/BCDI estimate relies on the method adopted in William Cline’s (2008) SMIM. Utilizing commerce elasticities, the overvaluation is outlined because the p.c depreciation required to carry the present account to steadiness over time, requiring consistency throughout all different present account balances. Nevertheless, Cline’s method didn’t assume zero balances have been the targets. Therefore whereas the general mathematical framework is similar (matrices, matrices!), the targets are fairly completely different. So as to see how loopy this zero steadiness criterion is, because of this “fair” change charges are those who imply zero present account balances, which in flip means zero monetary account balances. In different phrases, international locations could be neither debtors nor savers within the medium run. Right here’s what this implies when it comes to an intertemporal mannequin.

Word that no intertemporal commerce outcomes (on this case) in a decrease indifference curve.

See dialogue of earlier CPA analyses of the greenback’s worth, right here. Dialogue of measuring misalignment, right here. Distinction with the IMF’s EBA right here.

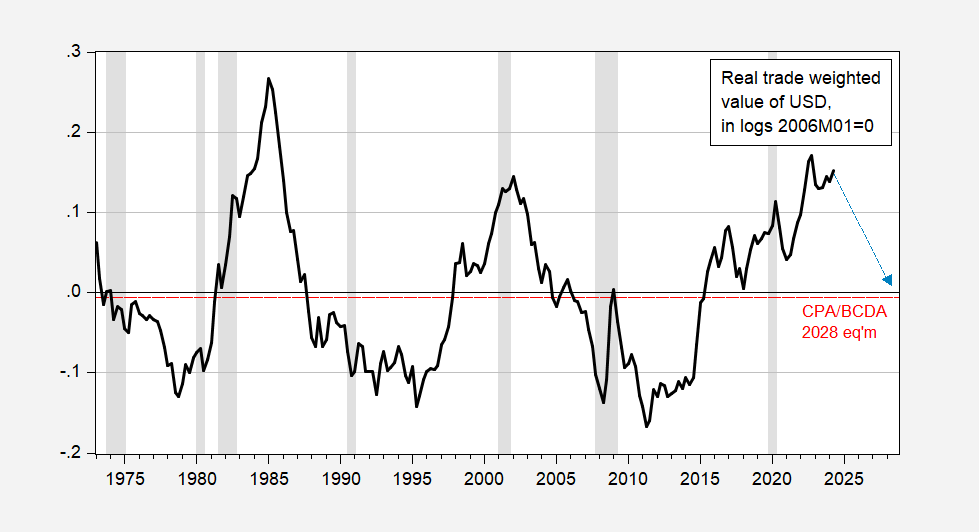

Right here’s the implied path for the greenback to hit CPA/BCDI “equilibrium” by 2028.

Determine 2: Broad actual greenback worth (black), CPA/BCDI “equilibrium” for 2028 (crimson dashed line), and implied path (blue dashed arrow). 2024Q2 statement is for April. NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve by way of FRED, CPA/BCDI (April 2024), NBER and writer’s calculations.