Heritage Basis EJ Antoni channels ShadowStats:

“Government economic figures hide the truth about the economy…” Thang [sic] you,

@mises , for highlighting a current paper @profstonge and I wrote that explains how inflation has been vastly underestimated – learn the article by @RonPaul right here:

https://t.co/cVroe5QwCT

I’ve written a paper on the Antoni-St. Onge thesis that utilizing the “right” deflators means GDP in 2024Q2 is under 2019Q2 ranges, however right here I wish to spotlight one reality – what their various GDP deflator entails.

Supply: Antoni and St. Onge (2024).

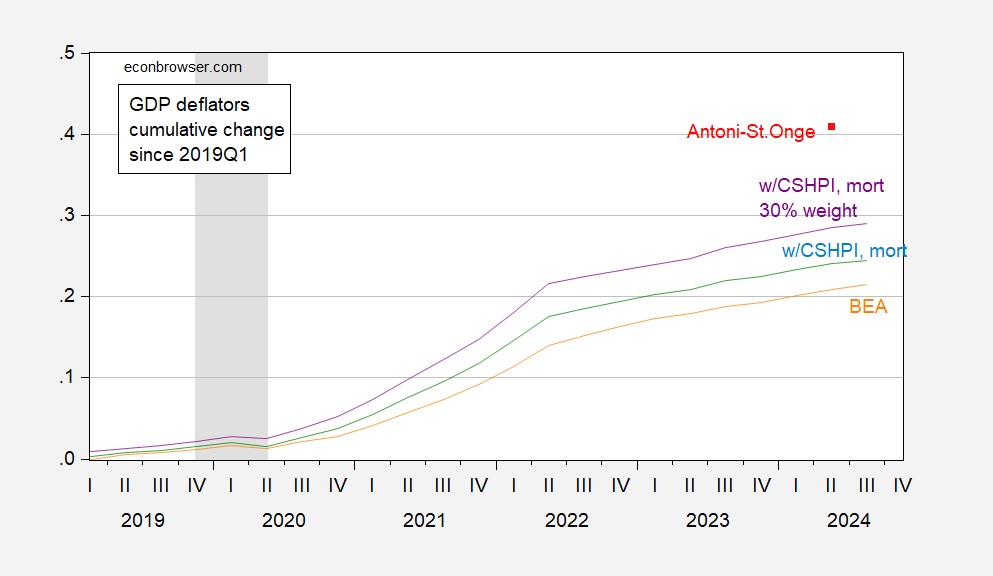

Discover the large orange space within the above graph, which Antoni and St. Onge attribute to their improved remedy of housing prices. I attempt to comply with their argument, utilizing the product of home costs (Case Shiller nationwide home worth index) and 30 yr mortgage charges rather than the BEA’s part. I modify actual consumption accordingly (the authors don’t point out adjustment to funding or authorities spending), and recalculate GDP (as proven within the paper). Updating the calculations with the latest home worth and NIPA information, I get hold of the next image of the implied deflators.

Determine 1: GDP deflator from BEA (orange), implied deflator changing BEA housing prices with product of home costs and mortgage fee, at 15% weight in consumption (mild blue), and at 30% weight (purple), and Antoni-St.Onge implied GDP deflator (purple sq.), all relative to 2019Q1. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER, creator’s calculations.

In different phrases, I can’t determine how Antoni and St. Onge calculated their various GDP, nor their various deflator.