The Federal Reserve’s FOMC slashed the goal federal funds fee at its assembly this month, lowering the goal fee by 50 foundation factors from 5.5 p.c to five.0 p.c. This was the most important reduce to the goal fee since March of 2020 within the midst of the Covid Panic.

This reduce comes after fourteen months of the FOMC holding the goal fee at 5.5 p.c. In late 2022, the FOMC was compelled to permit rates of interest to rise in response to mounting worth inflation which hit a year-over-year progress fee of 8.9 p.c in June 2022. For the reason that official CPI inflation fee fell again beneath 5 p.c in Spring of 2023, nonetheless, there was persevering with hypothesis a few “Fed pivot” wherein the Fed will as soon as once more start a cycle of cuts to the goal rate of interest.

This pivot lastly got here in the present day, and extra cuts are anticipated. In accordance with the FOMC’s Abstract of Financial Projections, most FOMC members report they consider the “appropriate target level” for the Federal funds fee will are available in beneath 5.0 p.c for 2024. This strongly suggests we should always count on extra fee cuts by the top of the yr.

That is all a transparent sign that the Fed and FOMC consider the financial scenario is worsening. For political causes, nonetheless, Fed Chairman Jerome Powell continues to insist that this month’s massive reduce to the goal fee is certainly, completely not in response to worsening financial knowledge.

Through the post-FOMC press convention in the present day, Fed Chaiman Jerome Powell repeatedly tried to take an upbeat tone in regards to the state of the US economic system explicitly stating—in his personal phrases—”the US economic system is in nice form” and “the labor market is in solid condition.”

But, if one appears to be like intently, one won’t discover a case of the FOMC slashing the goal rate of interest by 50 foundation factors when the economic system “is in great shape.” Quite the opposite, a 50 bps (or bigger) reduce to the goal fee tends to come back only a few months earlier than recession and a rising unemployment fee. If one appears to be like solely on the unemployment fee in these circumstances, one may see how the economic system would possibly look first rate even when the Fed begins a rate-cutting cycle. During the last thirty years, 50-basis-point panic cuts come when the unemployment fee is barely up from current lows:

However, unemployment charges inevitably rise after the rate-cutting cycle begins. For instance, we see rate-cutting cycles start within the late Nineteen Eighties, in 2001, and in 2007. All precede precessions by a yr or much less. Furthermore, the Nice Recession, which started in December of 2007, was preceded by a 50 bps reduce only a few months earlier, in September of that yr. A yr after that the unemployment fee was 6.5 p.c, and peaked at 9.9 p.c in early 2010.

Regardless of all this Powell acknowledged in the present day that because of this fee reduce he expects the economic system to “expand at a solid pace.” But this prediction runs opposite to the information popping out of member Fed banks. For instance, within the August Beige E-book, solely three of 11 Fed districts reported any financial progress in any respect. Dallas, Boston, and Chicago reported their economies “expanded modestly” or “increased slightly.” 4 of the Fed districts reported financial exercise “fell” or “declined slightly.” All different districts mentioned the economic system was flat.

This form of language in a Beige E-book is outstanding, nonetheless, as a result of Fed publications of this kind at all times err on the facet of downplaying any financial misery. The financial scenario needs to be fairly bleak earlier than we’ll see the Fed banks report an financial scenario worse than “moderate growth.” (Certainly, whereas many economists had been predicting solely a 25 bps reduce to the goal fee, Bloomberg’s Anna Wong predicted a 50-point reduce based mostly largely on Beige-E-book pessimism.)

The FOMC would have you ever consider that this spherical of fee cuts gained’t be like all the remaining, and in the present day 50-point reduce is merely a relaxed and picked up effort to steer the US economic system to a comfortable touchdown. If this performs out this fashion, it is going to be the primary time in Fed historical past.

It’s unattainable to know what Powell and the FOMC members actually consider the economic system, in fact, as a result of they must say that all the things is ok for political causes. The Fed completely by no means comes out and says “yes, folks, we think recession will be here in a few months. Get ready” It ought to be remembered that in Spring of 2008, Ben Bernanke was nonetheless confidently claiming that there was not even a recession on the horizon—regardless that the recession had begun in late 2007.

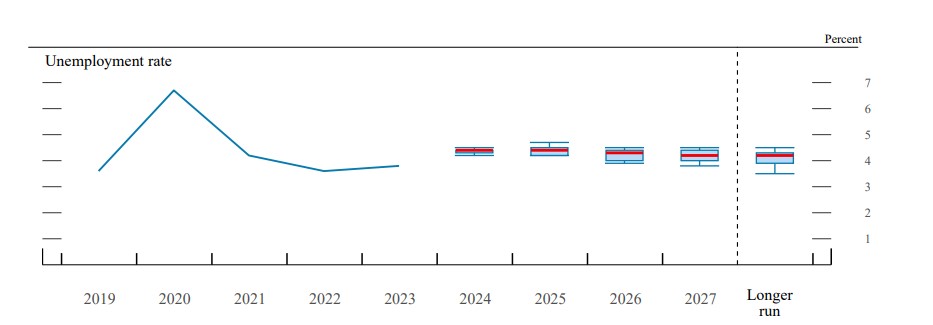

This time, true to type, FOMC members, within the Abstract of Financial Projections, predicted that the unemployment fee will likely be flat or falling from now till not less than 2027. These predictions run counter to just about all the things we learn about how rising unemployment charges are inclined to observe—though usually are not triggered by—fee cuts.

Even most of the reporters within the room throughout Powell press convention knew this. The truth is, one of many extra brave reporters on the assembly requested Powell why he appears to suppose that the FOMC’s fee reduce will this time be adopted by sustained, low unemployment charges. In different phrases, she basically requested “explain to us why this time is different.” Powell supplied no reply besides to mumble in a wide range of totally different ways in which the economic system is doing properly.

Given the timing of this reduce to the goal fee—that’s, a couple of weeks earlier than a nationwide election—Powell clearly felt he wanted to justify the transfer as not being politically motivated. In any case, if the economic system is so “great” and “solid” why is the FOMC slicing charges in any respect?

Extra astute observers already know: the Fed solely makes massive 50-point fee cuts when it fears substantial job losses. Job losses are a political downside. The explanation the Fed in any other case doesn’t make such massive cuts to the goal rate of interest is as a result of cuts to the goal fee are inflationary and worth inflation is additionally a political downside. Thus, the place the Fed comes down on fee cuts tells us what which the Fed believes is extra of a political downside at any given time: the Fed cuts when it fears job losses and recession extra. The slowing economic system will then be disinflationary and the Fed doesn’t have to fret about worth inflation.

However, if the Fed holds regular, or permits charges to rise, then it fears worth inflation extra.

These are political concerns. The Fed isn’t within the enterprise of optimizing financial efficiency, and it actually has no manner of centrally planning the economic system in a manner that may guarantee this occurs. Quite, the Fed exists to make sure liquidity and low cost loans for the central authorities whereas additionally guaranteeing a continuous stream of straightforward cash for the banker class.

The Fed by no means admits this, in fact. Powell framed the speed reduce as designed to make sure the present “great” economic system continues. When requested about what knowledge any future fee cuts may be based mostly on, Powell provided the same old, inventory rationalization of how the Fed is data-driven and appears solely at jobs knowledge and financial exercise. However, he was then positive to say “we don’t look for anything else” whereas making an attempt to sound informal. What he means was the Fed doesn’t contemplate any political data in its decision-making.

He then went on to say “everything we do is in service to our public mission” and that the Fed is strictly dedicated to “the people that we serve,” by which he presumably meant the American public.

General, in the present day’s press convention was surprising in simply how unconvincing Powell was. Apparently, Powell and his fellow Fed technocrats actually do suppose it’s completely believable to slice the Federal Funds fee after which additionally declare that the economic system is doing very properly. Powell and the opposite FOMC members apparently consider there may be nothing in any respect implausible about FOMC members insisting that the unemployment fee will stay just about unchanged round 4.3 p.c for the following three years.

The Fed is determined so that you can suppose that “this time is different.” Sadly, Powell can’t appear to give you rationalization of why that’s the case.