With the commercial manufacturing launch at this time (+0.8% vs. +0.2% m/m consensus), we’ve the next image of key collection adopted by the NBER’s BCDC:

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring darkish blue), Bloomberg consensus of 9/6 for NFP (blue +), implied NFP from preliminary benchmark (blue), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/3/2024 launch), and writer’s calculations.

Be aware that the incorporation of the preliminary benchmark (which could overstate the eventual NFP downshift — see right here) nonetheless exhibits continued development by means of 2024M08.

Some different indicators — coincident index for month-to-month GDP, Philadelphia Fed’s early benchmark for official (pre-benchmarked) NFP, manufacturing manufacturing for industrial manufacturing, retail gross sales for manufacturing and commerce business gross sales — in Determine 2. Retail gross sales +0.1% vs. -0.2% m/m consensus).

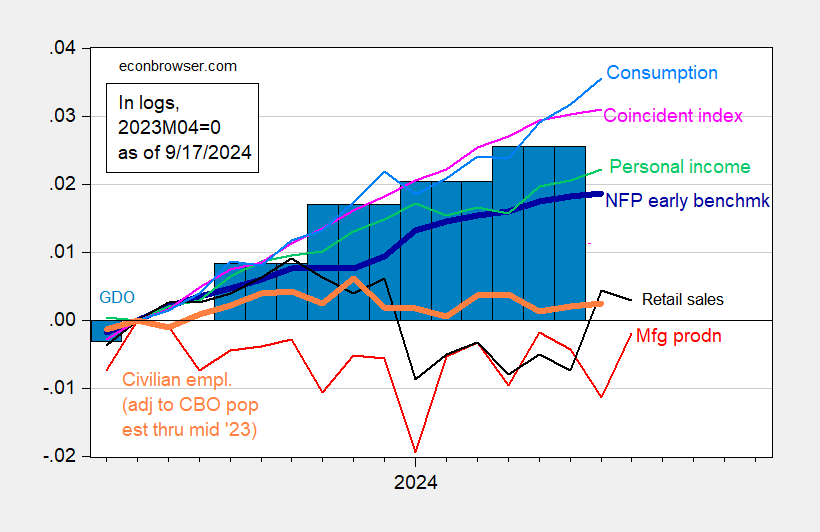

Determine 2: Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates by means of mid-2023 (orange), manufacturing manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (mild inexperienced), retail gross sales in 1999M12$ (black), consumption in Ch.2017$ (mild blue), and coincident index (pink), GDO (blue bars), all log normalized to 2023M04=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Supply: Philadelphia Fed, Federal Reserve through FRED, BEA 2024Q2 second launch, and writer’s calculations.

Not one of the indicators appear to point out a downturn in August, though manufacturing — and extra lately retail gross sales — have proven some sideways-trending. Nonetheless, we nonetheless must see private earnings ex-transfers (a key indicator adopted by the NBER’s BCDC) and consumption for August.

GDPNow as of at this time is 2.5% q/q AR for Q3. Goldman Sachs has upped its monitoring estimate to 2.8%.