COFER knowledge via December 2023:

Determine 1: International trade reserves in JPY as share of tota reserves (blue), AUD (mild blue), CAD (inexperienced), CNY (crimson). Supply: IMF COFER, entry 6/18/2024, and writer’s calculations.

Peak CNY was 2022Q1 at 2.6%, whereas newest is at 2.1%.

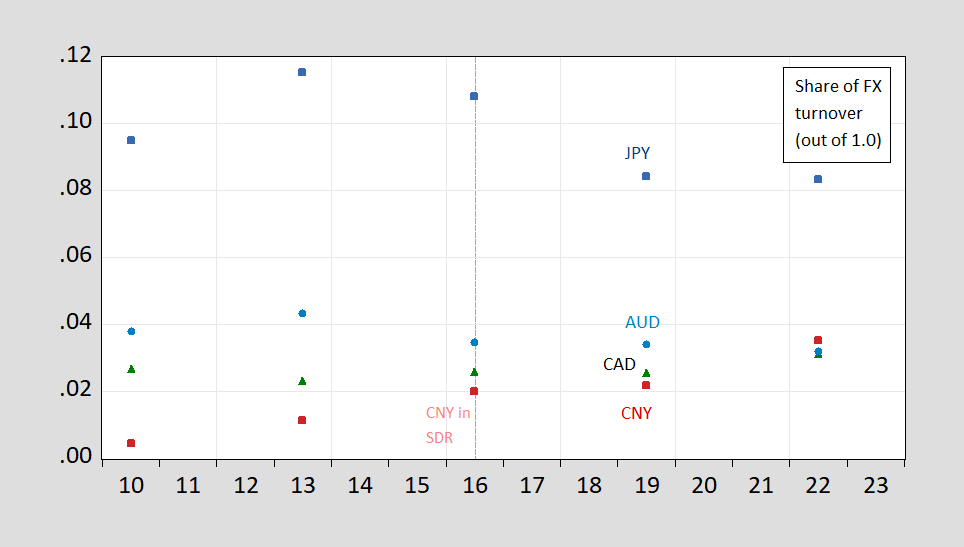

By way of every day international trade turnover, CNY was rising via April of 2022.

FIgure 2: International trade turnover share in April in CAN (blue sq.), in AUD (mild blue circle), in CAD (inexperienced triangle), in CNY (crimson sq.), out of 1.00. Supply: BIS Triennial Survey, 2022.

What’s occurred to turnover since 2022 is an attention-grabbing query, significantly in mild of the burgeoning commerce between Russia and China, and therefore invoicing/settlement in CNY. Right here’s CSIS’s estimate of invoicing in RMB from 2011 to 2023Q1.

Supply: DiPippo and Palazzi (2024).

This final graph signifies how the CNY can achieve in use as worldwide forex, pushed by commerce which China dominates in, whereas dropping favor as a reserve forex, or a car forex. Nevertheless, the hole between what occurs within the monetary sphere, vs. the commerce sphere, reinforces for me the proposition that so long as traders stay suspicious of Chinese language authorities intents with respect to political threat (together with tighter capital controls), one shouldn’t count on additional giant positive aspects in use of the CNY as a reserve forex.