The survey signifies 2.0% median progress this fall/this fall, not removed from June SEP at 2.1% (unchanged from March).

Determine 1: GDP (daring black), Might Survey of Skilled Forecasters median (blue), FT-Sales space College implied (tan sq.), Survey of Financial Projections/FOMC June median implied (mild inexperienced x), GDPNow of seven Jun implied (sky blue sq.), all in bn.Ch.2017$ SAAR. Supply: BEA 2024Q1 2nd launch, Philadelphia Fed, Sales space College survey, Federal Reserve Board, Atlanta Fed, and writer’s calculations.

Whereas median is 2.0% 2024 this fall/this fall, the tenth/ninetieth percentile vary is 1.8%-2.7%. I used to be significantly extra gloomy, with median at 1.8% (0.8% to 2.5%). Central tendency for SEP (eradicating backside and prime 3) is 1.9%-2.3%, vary (all responses) is 1.4%-2.7%.

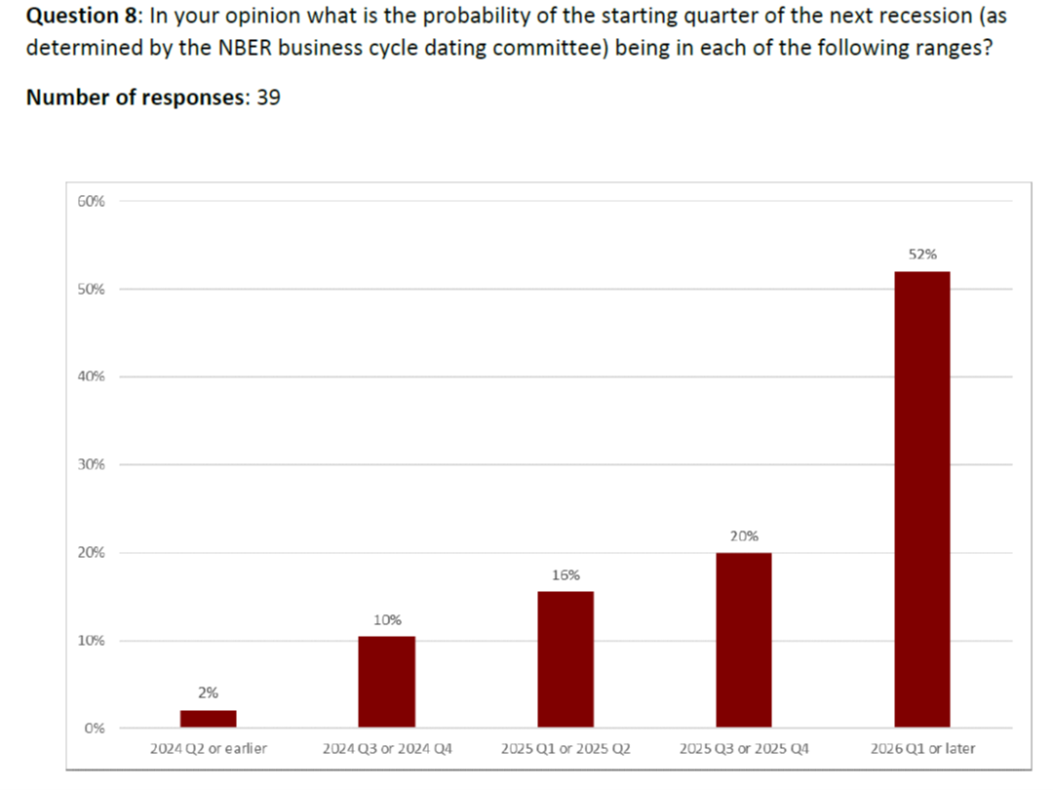

The modal response for recession begin is now 2026Q1 or later, in comparison with March (see right here).

Supply: FT-Sales space College survey (June 2024).

The chance of a recession begin in 2024 has dropped from 18% in March to 12% in Might, whereas the modal prediction of 2026Q1 or later has risen from 46% to 52%. As soon as once more, I’m extra gloomy brief time period, at 40% chance in 2024, reflecting the implications of the time period unfold (however protecting in thoughts the debt-service ratio).

FT article right here.