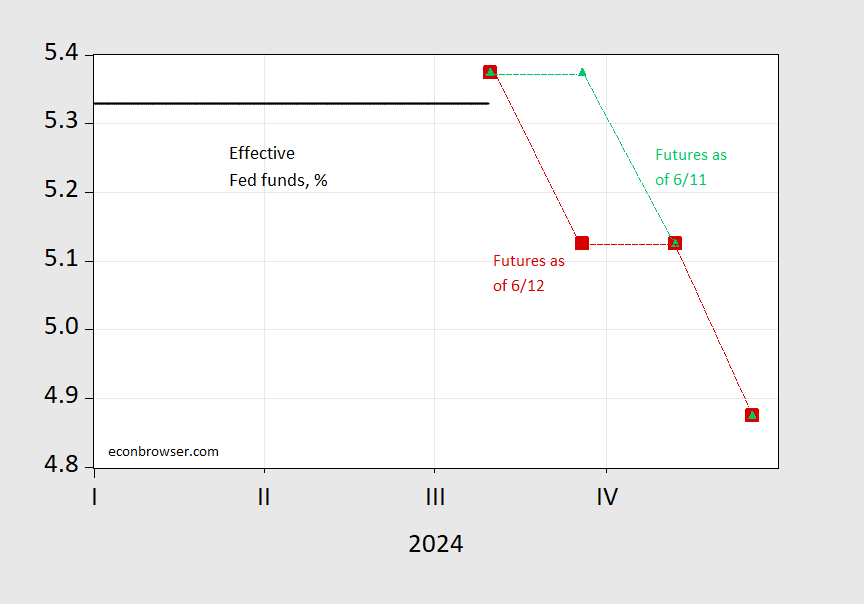

Right here’s an image of the Fed funds pre- and post-CPI launch/FOMC SEP:

Supply: CME accessed 6/12/2024, 1:30pm.

Earlier than the information, the implied drop over 2024 was 35 bps, now 39 bps. What number of drops? Utilizing modal possibilities:

Supply: CME accessed 6/12/2024, 1:30pm.

Two 25 bps drops earlier than, two drops after the information.

Present commentary stresses that the shut steadiness between one and two cuts within the SEP (see SEP right here).

Market expectations (i.e., ex ante measures) are essential for conduct. Which one will turn into extra correct by way of forecasting. This challenge is taken up in Carpinelli et al. (2024).